Targets for improving municipal waste management

Improving the management of municipal waste has been a long-standing objective of EU waste policy, with the aim of harvesting useful resources from waste and reducing its environmental harm through better management. The EU Waste Framework Directive requires that EU Member States increase the share of municipal waste prepared for reuse or recycled to 55% of all municipal waste generated by 2025, 60% by 2030 and 65% by 2035. Moreover, by 2035, no more than 10% of all municipal waste should be landfilled, as required by the EU Landfill Directive. The EEA has assessed Member States’ prospects of meeting the 2025 target based on a number of influencing factors, such as their distance from target, the economic instruments they apply, the separate collection systems they have in place and their plans for improvement. The analysis carried out is the basis for this briefing.

Key instruments for supporting recycling and reducing landfill

Economic instruments can be useful policy tools for waste prevention and sustainable waste management. This is because they can make preferred management options, such as recycling, cheaper than or at least cost-competitive with their alternatives (OECD, 2019). Next to economic instruments, well-designed separate collection systems for municipal waste are a key enabler of high recycling rates and the collection of recyclables of adequate quality. To facilitate recycling, the EU Waste Framework Directive requires that at least paper and cardboard, plastics, glass and metals are collected separately from mixed municipal waste. Separate collection will be required for bio-waste (food and garden waste) by the end of 2023 and for textiles and hazardous household waste by the end of 2025. Box 1 summarises the main instruments used to improve municipal waste management in EU Member States.

Other types of economic instruments relevant to municipal waste — not further analysed here — are deposit-return schemes, product taxes and extended producer responsibility schemes, which usually target certain products, including those that end up in municipal waste.

Several other EU waste directives, such as the Packaging and Packaging Waste Directive and the Waste Electrical and Electronic Equipment Directive, address certain types of waste included in municipal waste and set targets for collection and/or recycling. The proper implementation of these directives will help the EU and its Member States to meet municipal waste recycling targets.

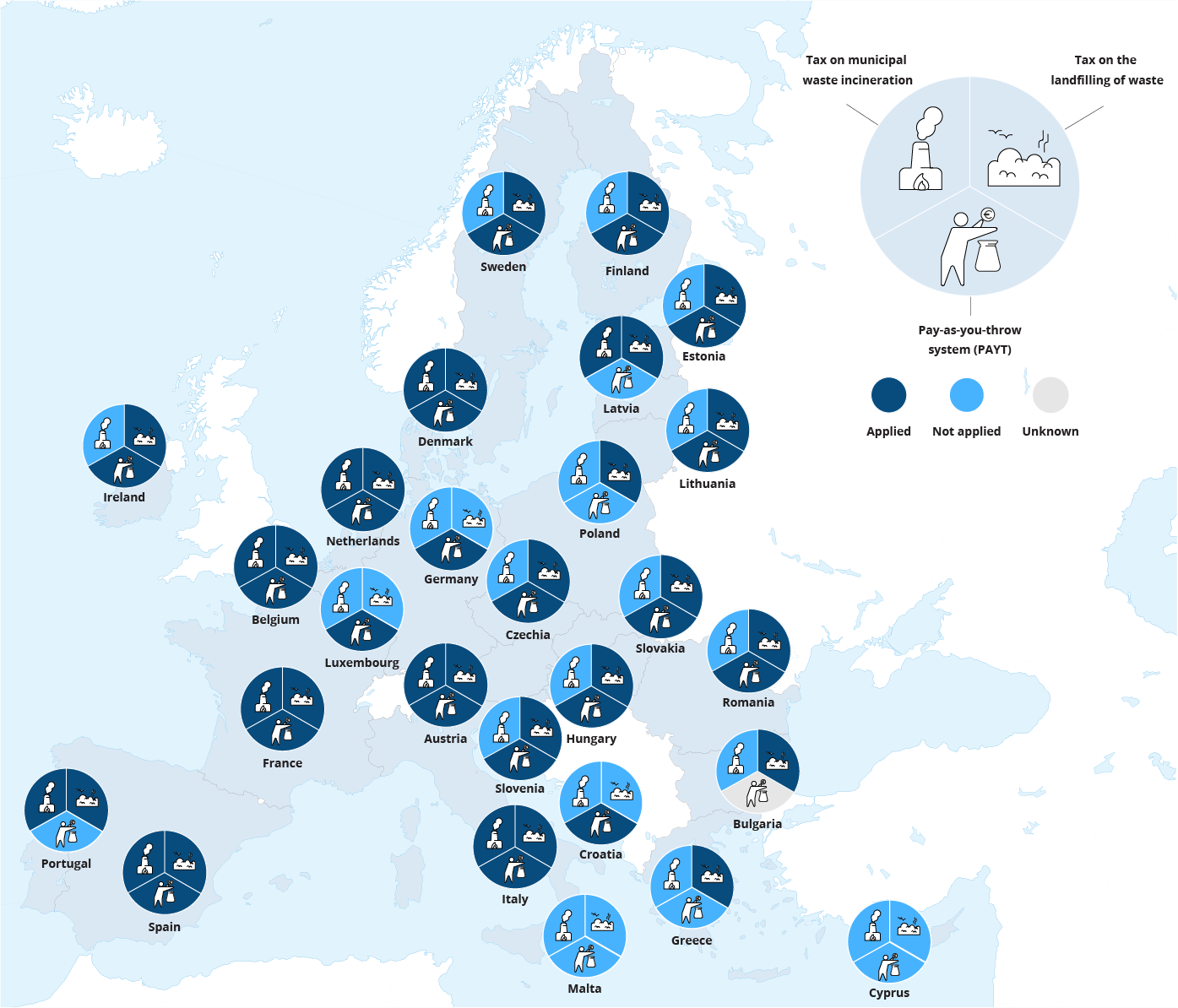

Across the EU, landfill taxes are the most widely implemented instrument (22 Member States), followed by pay-as-you-throw (PAYT) systems (20 Member States) (Figure 1). Taxes on the incineration of municipal waste are implemented by only nine EU Member States and so cannot be considered widespread. However, this in part reflects the fact that five Member States do not have any municipal waste incineration plants.

Note: More details available in the Technical note.

Source: Compiled by the European Topic Centre on Circular Economy and Resource Use (ETC CE) based on the EEA early warning assessments related to the 2025 targets for municipal waste and packaging waste (EEA and ETC CE, 2022).

Economic instruments driving good waste management performance

Table 1 provides an overview of the current rates of recycling, landfill and incineration in the 27 EU Member States along with the main economic instruments applied and the coverage of the population with high-convenience separate collection systems for bio-waste.

Notes: Recycling, landfill and incineration rates refer to 2020, other than for Bulgaria, Greece and Spain, which refer to 2019. The assessment of the policy instruments, namely the use of landfill taxes or bans, incineration taxes, pay-as-you-throw (PAYT) systems and bio-waste collection, was based on their status in spring 2022. The colours indicate the extent to which the policy instruments were implemented by each Member State. See Technical note for a more detailed explanation of the colour codes. Data might not be fully comparable across all Member States given the ongoing transition to the new reporting rules defined by the EU Waste Framework Directive. Sweden had an incineration tax until 2022.

Sources: Rates for recycling, landfill and incineration were calculated based on Eurostat (2023). Categorisation of the policy instruments was based on the EEA early warning assessments related to the 2025 targets for municipal waste and packaging waste. Pay-as-you-throw (PAYT) system coverage and type was based on Table 2 and is explained in the Technical note.

When comparing Member States’ use of policy instruments with their recycling and landfill rates, some instruments emerge as highly relevant:

- All five of the Member States with the highest recycling rates (53-70%) — Germany, Austria, Slovenia, the Netherlands and Luxembourg — apply a well-designed landfill tax or ban, or a combination of these. The coverage of the population with high-convenience systems for the separate collection of bio-waste in each of these Member States is also high. Moreover, they all apply a combination of basic and advanced pay-as-you-throw (PAYT) schemes, albeit with varying population coverage.

- None of the five Member States with the lowest recycling rates (11-27%) — Malta, Romania, Cyprus, Greece and Portugal — applies a well-designed landfill tax or ban. In most of them, separate collection systems for bio-waste need to be improved. However, Malta has very recently put in place gate fees that are designed to disincentivise the landfilling of waste.

- No clear pattern is visible in the impact of incineration taxes on the rates of recycling, landfillling and incineration. However, higher taxes for incineration without energy recovery than with energy recovery seem to have led to a gradual phase-out of the former.

- The five Member States with the highest landfill rates do not have incineration plants.

- Table 1 indicates that, in some cases, a Member State can achieve good waste management performance without strong use of several of the instruments (for example Italy) and vice versa (for example Sweden). This could be because other instruments that drive performance are used in some Member States. For example, Italy has set targets for each municipality on the separate collection of municipal waste, an instrument not analysed systematically in this briefing. High existing incineration capacities might also compete with efforts to increase recycling. In addition, the effectiveness of the instruments depends on their exact design, implementation, timing and enforcement.

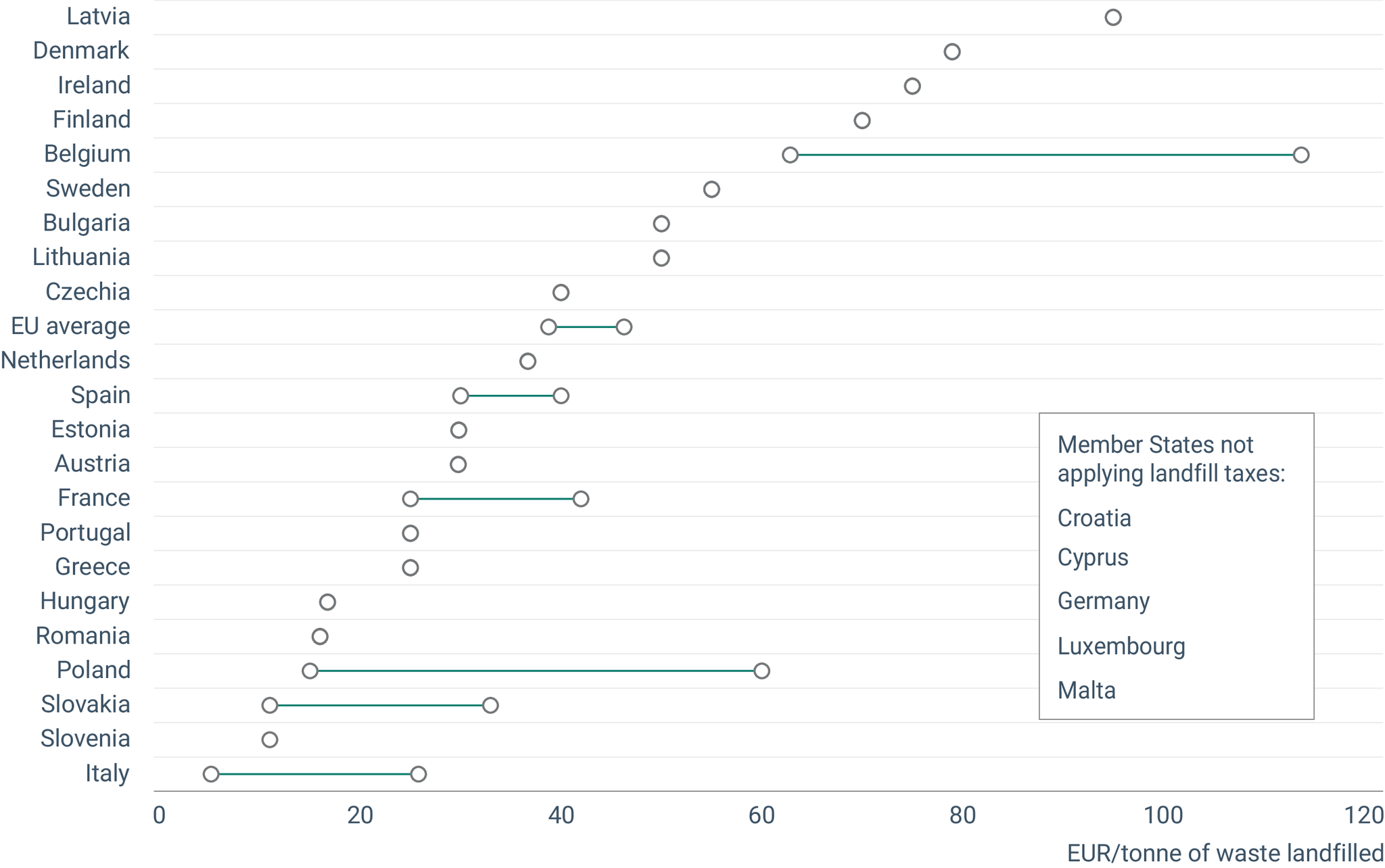

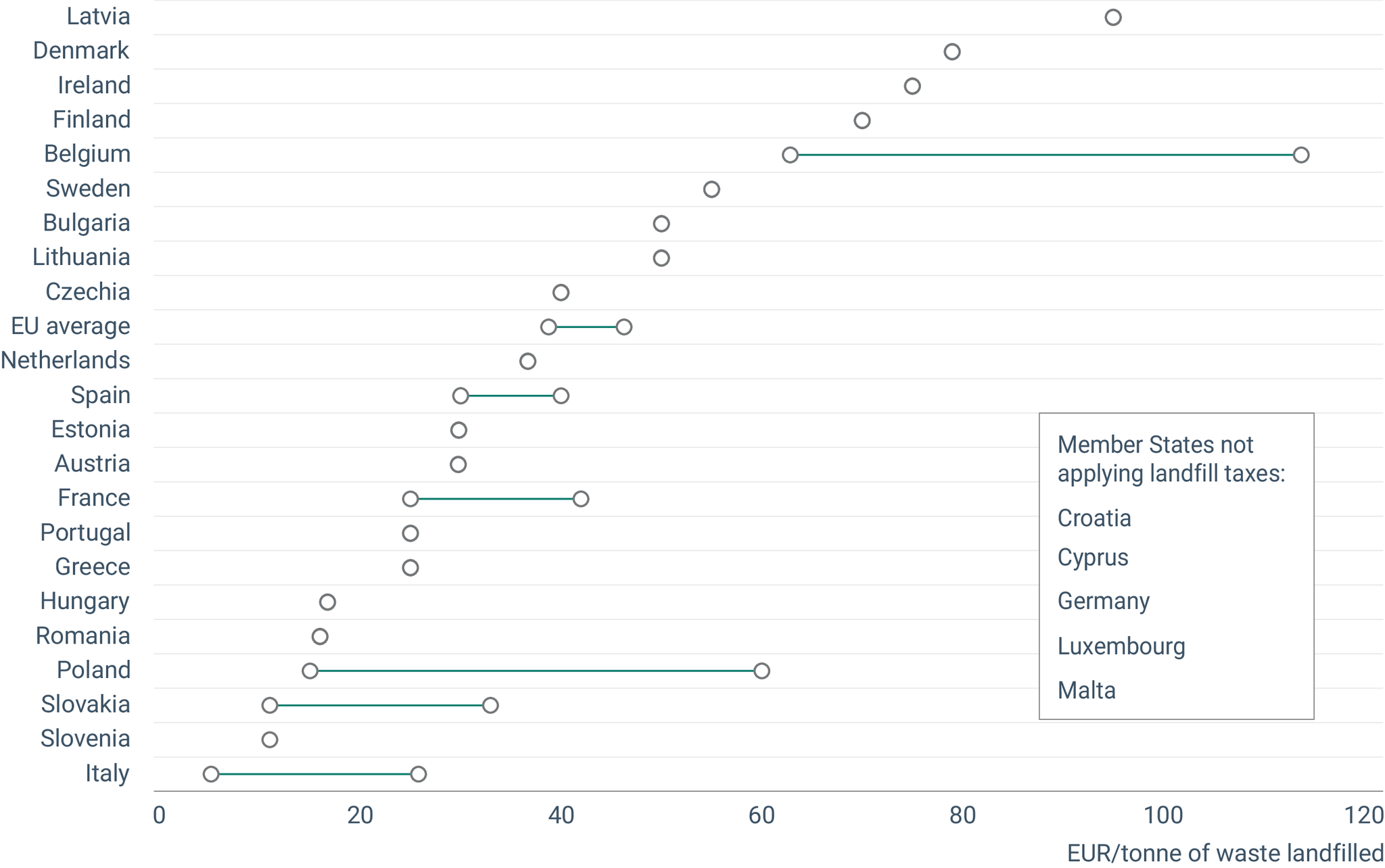

Taxes on the landfilling of municipal waste

Landfill or incineration taxes are levied with the aim of making these waste treatment paths more expensive and thus recycling or prevention more economically attractive, and/or of generating revenue that can be invested in better waste management. Landfill taxes are currently applied in 22 EU Member States. The EU (simple) average is approximately EUR39-46 per tonne of waste landfilled, with significant variation between countries, from less than EUR20 per tonne to over EUR100 per tonne (Figure 2). Tax levels can vary by type of waste or type of landfill, and Bulgaria, Czechia, Italy, Portugal and Slovakia apply tax breaks when municipalities meet certain conditions. Landfill taxes are also often combined with banning certain types of wastes from landfill, and some Member States apply bans but no taxes (Box 2). Landfill taxes in Czechia, France, Greece, Ireland and Portugal and the gate fee in Malta will increase in the coming years.

Note: Belgium: average for Flanders and Wallonia; lower level applies to non-combustible waste; higher level applies to combustible waste. France: tax rate depends on landfill design. Slovakia: tax ranges from EUR11 to 33 per tonne depending on the share of separately collected municipal waste in a municipality. Slovenia: tax applies to treatment residues of municipal waste. Poland and Spain: lower level applies to outputs of mechanical-biological treatment plants; higher level applies to untreated municipal waste. Italy: taxes are defined by the regions within the nationally defined range. Malta: no landfill tax, but landfill gate fees apply to mixed waste deposited at public waste management facilities, which is set to increase from EUR40 per tonne in 2023 to EUR120 per tonne in 2027. EU average: simple average of all Member States applying landfill taxes. Further details are described in the Technical note.

Sources: Compiled by the European Topic Centre on Circular Economy and Resource Use (ETC CE) based on the EEA early warning assessments related to the 2025 targets for municipal waste and packaging waste (EEA and ETC CE, 2022) and information received by country authorities during the Eionet review of this briefing (see Technical note).

Explore different chart formats and data here

Another widely used instrument to reduce landfilling is a ban on the landfilling of certain types of waste. Bans are often used in combination with or as an alternative to landfill taxes. EU Member States ban different types of waste:

- Belgium, Estonia, Hungary, Lithuania, Luxembourg, the Netherlands, Slovakia (from 2024) and Slovenia ban the landfilling of untreated municipal waste.

- Belgium, Czechia, Denmark, Finland, Slovenia and Sweden ban the landfilling of biodegradable waste.

- Austria, Germany, Luxembourg and Slovenia ban the landfilling of waste exceeding a certain total organic carbon value.

- Poland and Sweden ban the landfilling of combustible waste and Czechia (from 2030) bans the landfilling of waste exceeding a certain calorific value.

- Cyprus, Czechia, France, Malta and Slovenia ban the landfilling of separately collected recyclables and Latvia (from 2030) bans the landfilling of recyclable waste.

- Poland bans the landfilling of separately collected bio-waste.

Taxes on the incineration of municipal waste

Taxes on the incineration of municipal waste are imposed by only nine Member States (Figure 3). They are on average set at a lower level than landfill taxes. Belgium, France, Italy, Portugal and Spain apply lower taxes for incineration with energy recovery than for incineration without energy recovery. In reality, the higher tax rates are no longer relevant in these countries, as nearly all waste incineration is categorised as energy recovery (97% in Italy and 100% in the other four Member States, calculated based on Eurostat (2023)). Other Member States, for example Finland, ban the incineration of recyclables. Overall, there seems to be no clear link between the application and level of incineration taxes and the share of waste incinerated (Table 1).

Note: Belgium: lower level is the average for Brussels capital region, Flanders and Wallonia; upper level is for Wallonia only. Belgium, France, Italy, Portugal and Spain: lower value applies to incineration with energy recovery; higher value applies to incineration without energy recovery. Portugal: additional tax breaks for municipalities collecting bio-waste separately, and elevated tax for landfilling of recyclable waste. Spain: lower tax for rejects from pre-treatment than for mixed municipal waste. Sweden: incineration tax abolished in 2023. Denmark: tax depends on energy content and CO2 emissions per tonne of waste, so the figure represents a typical value for municipal waste. France: tax rate depends on landfill design. Further details are described in the Technical note.

Source: Compiled by the ETC CE based on the EEA early warning assessments related to the 2025 targets for municipal waste and packaging waste (EEA and ETC CE, 2022) and information received by country authorities during the Eionet review of this briefing (see Technical note).

Explore different chart formats and data here

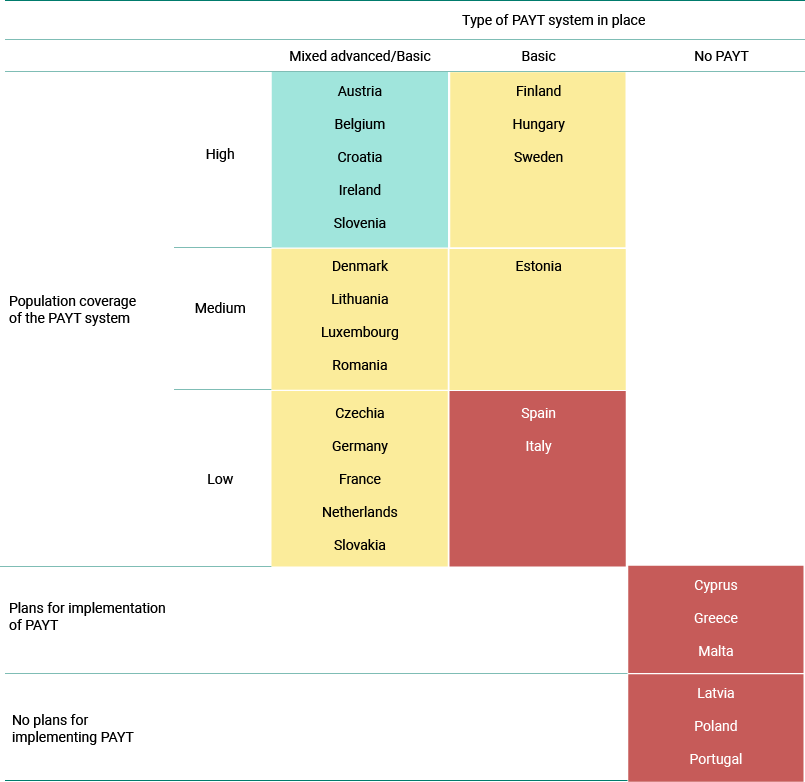

Pay-as-you-throw-based waste collection fees

PAYT systems aim to encourage citizens and/or other waste producers to separate waste at source and generate less waste overall. Under PAYT systems, waste producers pay for waste collection services in proportion to the volume of waste they produce and they pay less or nothing for recyclables separated at source. In some cases, variable fees are combined with fixed fees. PAYT systems typically have a favourable impact on recycling rates (OECD, 2019). It is thus expected that the higher the share of the population covered by such a system, the higher the recycling rates. Moreover, an ongoing study by the European Commission’s Joint Research Centre includes the prevalence of PAYT schemes as one of several key performance indicators of the quality control and traceability of municipal waste management systems (Pierri et al., forthcoming).

PAYT systems are designed in many different ways. In this assessment, we categorise the systems applied in EU Member States as basic or advanced, assuming that advanced systems would be more effective in influencing waste producers’ behaviour than basic systems by providing a stronger economic incentive to sort waste:

- Advanced PAYT systems provide a direct and visible economic incentive at the time the waste is generated. This includes waste collectors weighing waste containers on pick-up so that waste producers pay by weight of waste generated. Another example is sack-based systems, whereby citizens buy waste sacks from the municipality or service provider, providing an immediate signal of a citizen’s waste behaviour.

- Basic PAYT systems are, for example, volume-based systems that depend mainly on the size of the container and sometimes also take into account the collection frequency when determining the collection fee. Such systems include designs where households can choose the number or size of the containers for mixed municipal waste when the service contract is agreed.

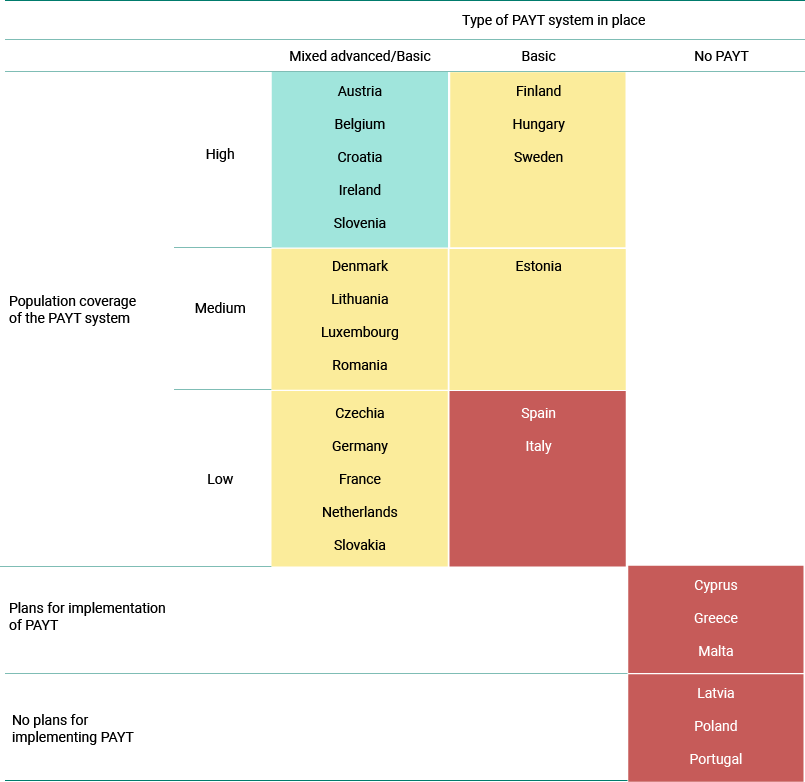

Across the EU, PAYT systems are a commonly used economic instrument (Table 2). The majority of Member States already have a PAYT system of some sort in place for at least part of the population. Most of these Member States have introduced legislation that requires the use or development of PAYT systems or allows municipalities to introduce such systems. Fourteen Member States use a mix of advanced and basic PAYT systems, and another six use basic PAYT systems only. No Member State uses only advanced PAYT systems. Three of the six Member States that currently do not use a PAYT system have firm plans in place to implement one.

Note: No information was available for Bulgaria. Poland applies a PAYT system to only non-household waste producers. Further details are provided in the Technical note.

Source: Compiled by the ETC CE based on the EEA early warning assessments related to the 2025 targets for municipal waste and packaging waste (EEA and ETC CE, 2022).

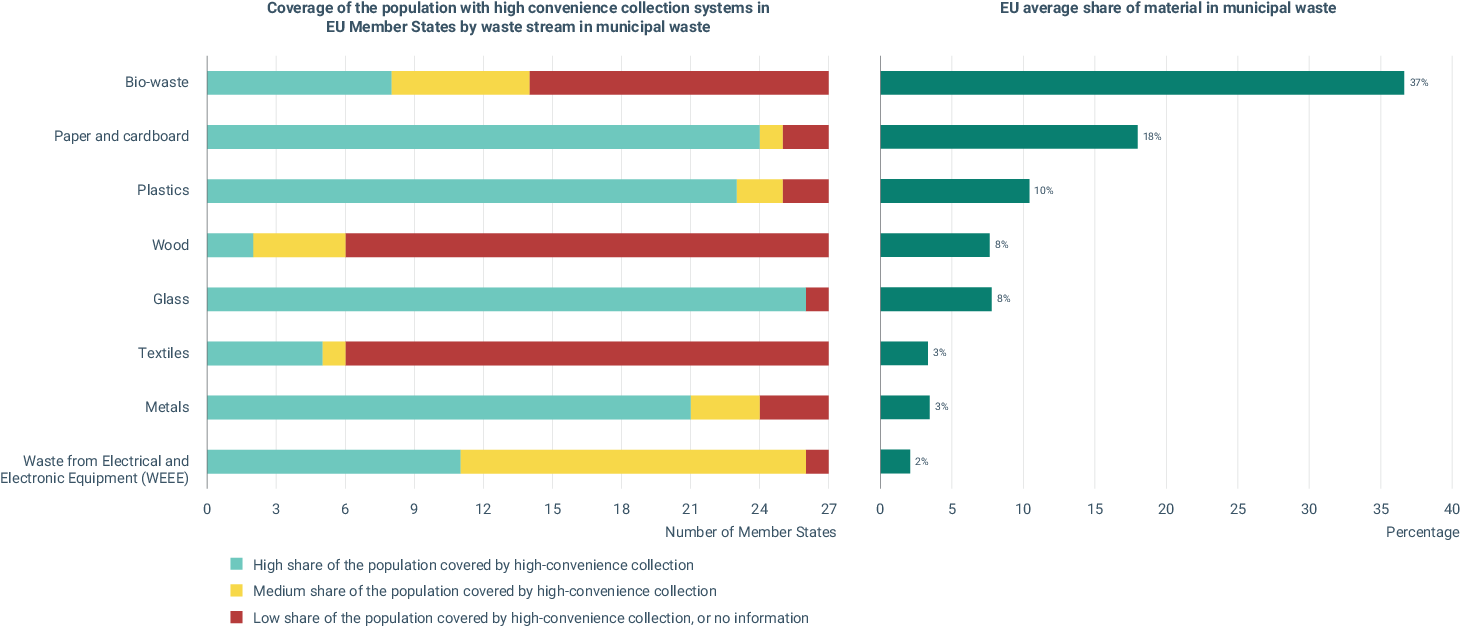

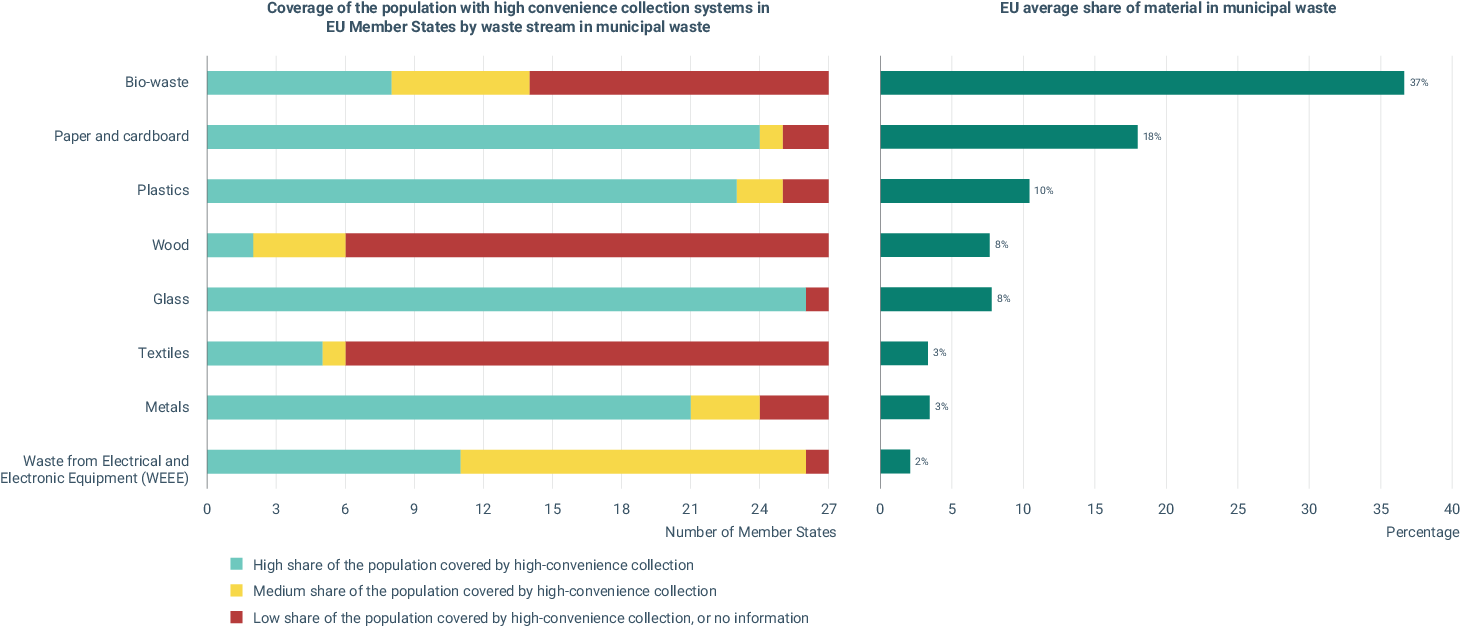

Separate collection

For good results, separate collection systems need to be easily accessible and convenient for citizens and other waste producers, to encourage them to contribute to waste recycling. In addition, collection results are improved by good communication and incentives for sorting at source. Different types of collection systems such as door-to-door collection, various types of recycling points and civic amenity sites offer different levels of convenience. Collection systems vary widely across but also within countries. Figure 4 indicates how many Member States provide high-convenience separate collection for the main material types for a high, medium or low share of their population.

Note: Separate collection systems for different materials are graded by how large a share of the population has access to a high-convenience collection system; shares of materials in municipal waste do not add up to 100%, as municipal waste includes other materials for which information is not available. See Technical note for more explanation of the grading methodology.

Source: Compiled by the European Topic Centre on Circular Economy and Resource Use (ETC CE) based on the EEA early warning assessments related to the 2025 targets for municipal waste and packaging waste (EEA and ETC CE, 2022).

Explore different chart formats and data here

To achieve a high recycling rate, it is important to capture well the materials that make up the largest share of municipal waste. On average, bio-waste (food and garden waste) constitutes the largest single fraction (37%), followed by paper and cardboard, plastics, wood, glass, metals, textiles and waste electrical and electronic equipment.

Because it is the largest component of municipal waste, collecting bio-waste separately is crucial for meeting recycling targets. Moreover, fostering home and community composting is an important strategy for reducing the amount of bio-waste managed centrally. Home and community composting could create local material cycles for bio-waste and might benefit from more systematic guidance across Europe. Given that the separate collection of bio-waste is not yet mandatory in all Member States, current systems are generally less well developed than those for the separate collection of paper and cardboard, glass, plastics and metals. Moreover, systems for garden waste collection are currently better developed than those for food waste collection across the EU. However, in response to the obligation to collect bio-waste separately by the end of 2023, the majority of Member States[1] have plans in place to increase the coverage of the population with separate collection systems for bio-waste or to improve the effectiveness of collection systems already in place.

Conclusion

The analysis described indicates that no single approach will achieve high recycling rates and divert waste from landfill but that a coherent and consistent combination of instruments is needed. For successful and effective waste management, how exactly the policy instruments are designed, implemented and enforced is also important. For example, if instruments such as landfill bans and separate collection requirements are not fully enforced across the whole territory, they will be less effective, while instruments directed at citizens need to be accompanied by good information and awareness-raising campaigns to realise their full potential. Moreover, capacities need to be built up to properly sort and recycle the waste collected. Other policy instruments not analysed in this briefing, such as economic instruments directed at certain products or legal obligations on separate collection, will also play a role.

Such information is, however, more difficult to track and compare across countries. This assessment is based on a set of relevant policy instruments, but the performance of Member States is influenced by other factors, including the mechanisms employed for ensuring that targets are met, which might explain why some Member States perform better or worse than others.

Notes

[1] Cyprus, Czechia, Denmark, Estonia, Finland, Greece, Portugal, Romania and Slovakia have firm plans in place to improve bio-waste collection. Belgium, Bulgaria, Croatia, France, Hungary, Ireland, Latvia, Lithuania and Spain have plans in place to improve it, but these are more vague.

References

EEA and ETC CE (2022), EEA early warning assessments related to the 2025 targets for municipal waste and packaging waste (https://www.eea.europa.eu/publications/country-profiles-early-warning-assessments) accessed 6 June 2023.

Eurostat (2023), ‘Municipal waste by waste management operations (env_wasmun)’ (https://ec.europa.eu/eurostat/databrowser/view/env_wasmun/default/table?lang=en) accessed 5 March 2023.

OECD (2019), Waste management and the circular economy in selected OECD countries: evidence from environmental performance reviews, OECD Environmental Performance Reviews, OECD Publishing, Paris (https://doi.org/10.1787/9789264309395-en).

Pierri, E., et al. (forthcoming), Quality management systems in waste collection — best practices and recommendations, Publications Office of the European Union, Luxembourg.

Identifiers

Briefing no. 29/2022

Title: Economic instruments and separate collection systems — key strategies to increase recycling

EN HTML: TH-AM-22-029-EN-Q - ISBN: 978-92-9480-535-5 - ISSN: 2467-3196 - doi: 10.2800/05314

EN PDF: TH-AM-22-029-EN-N - ISBN: 978-92-9480-534-8 - ISSN: 2467-3196 - doi: 10.2800/444518

Document Actions

Share with others