Financing Europe’s climate and energy objectives

EU climate and energy investment needs are substantial but manageable compared with the vast capacity of Europe’s financial system. These investments can fulfil headline climate and energy targetsandpay significant additional dividends in terms of job creation, reduced energy poverty, increased energy security, as well as improved air quality.

Targeted finance, well beyond the capacity of the public sector, will be needed to deliver Europe’s 2030 climate mitigation and energy targets. Reaching these targets will require a doubling of current annual investments in renewable energy and energy efficiency between 2021 and 2030.

EU analysis estimates the investment gap at the EU level to be in the order of EUR 177 billion per year. However, corresponding Member State specific information is not available in this estimate.

Assessing the state of play — new EEA study

Against this backdrop, the EEA commissioned a first stocktaking exercise of its kind involving its European Environment Information and Observation Network (Eionet) to help assess the current state-of-play on domestic climate finance tracking of public and private financial flows across Europe.

The main focus of the study, Assessing the state-of-play of climate finance tracking in Europe, was to identify the main data and knowledge gaps involved in tracking domestic climate finance in EEA Member Countries and at the EU level.

The study confirms that there are multiple data and knowledge gaps across all levels of analysis: national, European, private sources of finance, as well as on the sectoral level.

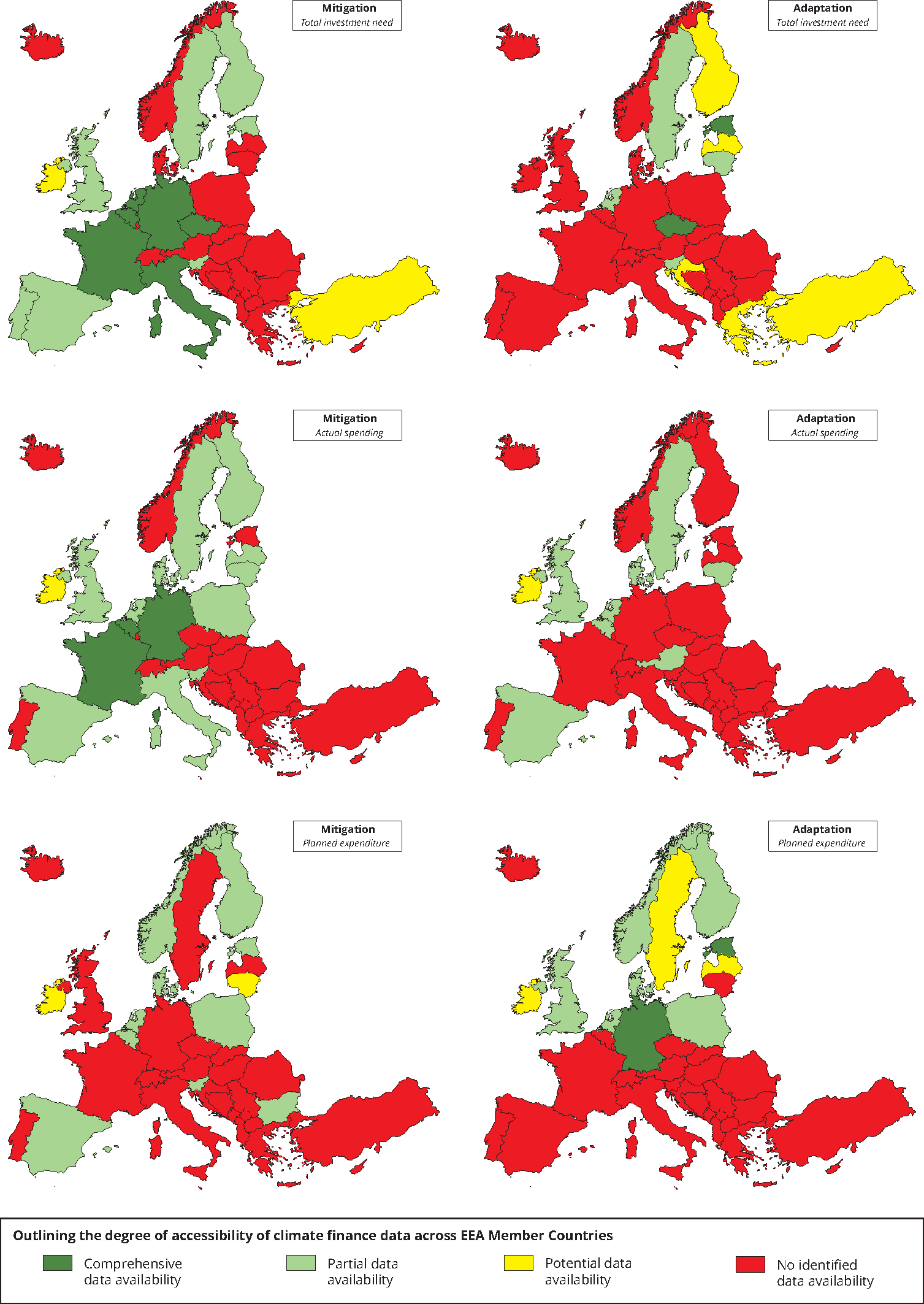

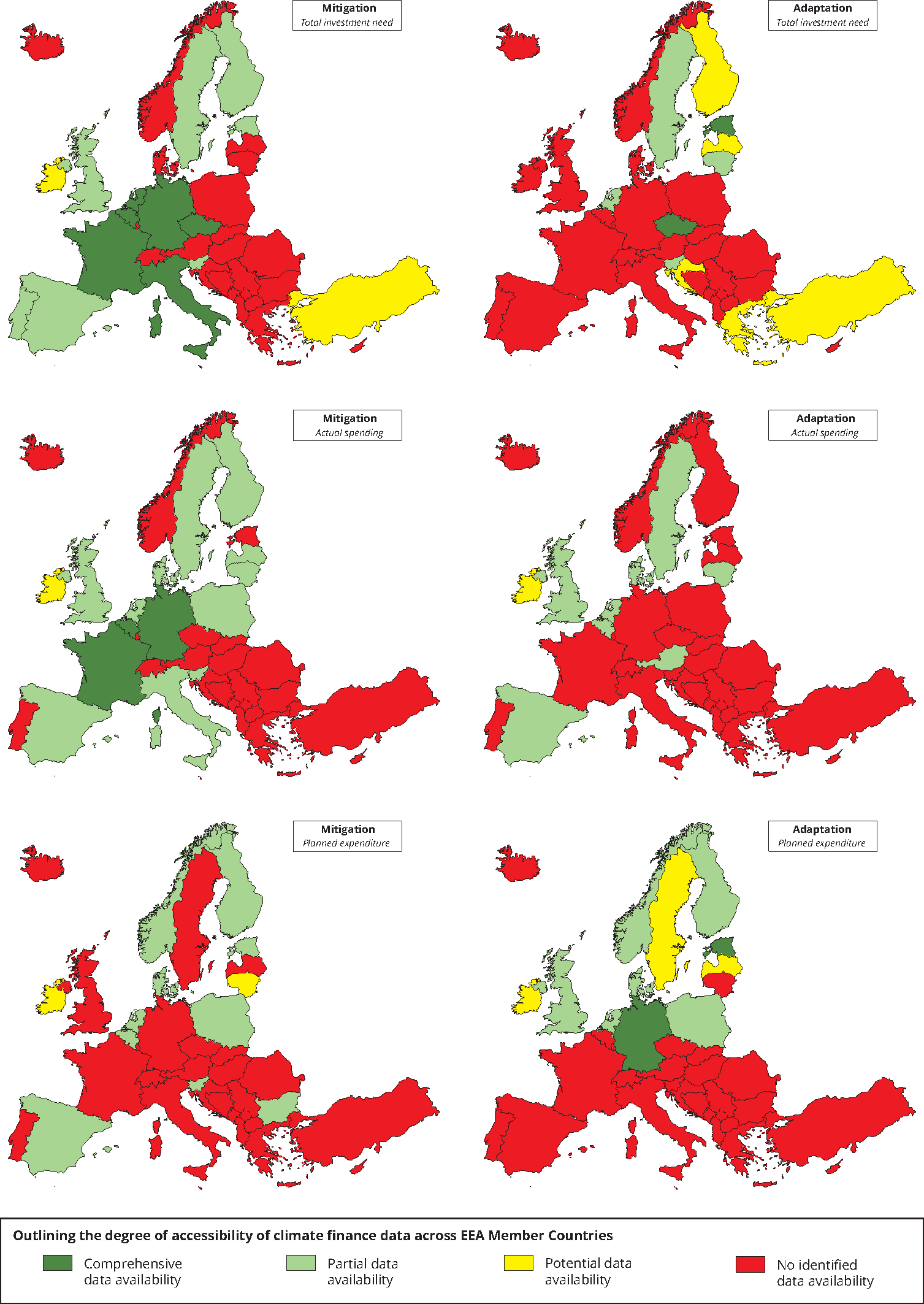

Country level

There is a general lack of comprehensive data availability on estimated climate investment needs as well as actual and planned climate finance spending. Only a handful of reported national Low-Carbon Development Strategies include quantified figures on estimated investment needs to achieve the outlined climate and energy targets. Only Belgium, France and, to some extent, Germany appear to have a more systematic approach for tracking actual spending related to climate mitigation activities using so called ‘climate finance landscapes’.

Domestic ‘climate finance landscapes’ support decision making and policy development.

Climate finance landscapes are comprehensive studies mapping financial flows dedicated to climate change action and energy transition. Covering both end-investment and supporting financial flows from public and private stakeholders, landscapes draw the picture of how the financial value chain links sources, intermediaries, project managers and the end-investment.

Climate finance landscapes help policy-makers to:

- monitor and assess current and planned spending towards overall investment needs;

- report to domestic or international processes;

- diagnose the effectiveness (success) and efficiency (value for money) of policy measures;

- compare countries, climate action areas and instruments;

- recommend solutions to close the gaps and mismatch in the financial value chain;

- coordinate and plan for improved financing strategies, better connecting capital and projects;

- shape and support national capital-raising plans to meet climate and energy objectives.

Domestic climate finance landscapes support decision making

The study outlines different features of climate finance landscapes and outlines how they have been applied in Belgium, France and Germany to track the roles of different financing sources, measure the effectiveness and efficiency of policy instruments to close investment gaps and assist institutions in devising new instruments and public intervention to re-direct financial flows from carbon-intensive to low-carbon investments at lesser cost.

Assessing EU level progress in public and private financing

The study suggests there is need for a more transparent split at the EU level between climate mitigation and adaptation spending of the overall EU budget and EU financial institution investment available for climate-relevant spending.

This in turn makes it difficult to assess progress in EU public spending on specific climate action areas and also prevents improved decision-making as to where the EU budget is best spent in terms of supporting the transition to a low-carbon, climate-resilient society and economy.

The private sector is expected to contribute the largest share of the remaining overall climate and energy financing needs. Yet it is the source of finance where least available data exists. Data from private sources would in particular help to strengthen the understanding about historic trends and current spending levels for the various mitigation and adaptation action areas and how these are financed. Currently, this information is primarily available for renewable energies. If it were to become available for other climate mitigation and adaptation action areas, the remaining investment challenge could be defined more accurately.

Barriers to better finance tracking

Barriers to better domestic climate finance tracking identified in the study include: weak links (organisational and communication) between relevant ministries, and lack of data, technical knowledge, common definitions, scope and tracking methodologies.

However there exists a clear interest and willingness among countries to engage in the further development of domestic climate finance tracking throughout Europe.

Climate adaptation

The data availability regarding finance for climate adaptation is generally less developed than finance information for climate mitigation, reflecting the more dispersed and integrated character of adaptation measures. Benchmark examples at the Member State level include Estonia and the Czech Republic where information exists covering detailed total investment needs associated with their established National Adaptation Plans. Estonia and Germany also constitute best practice examples with data availability for planned climate adaptation expenditures.

Improving the availability of climate finance information

The study identifies a lack of country-level preparedness and information regarding estimated total investment needs, as well as their current and planned expenditure volumes for climate and energy purposes. As a result, the EU estimates of total climate finance investment needs are not matched by complementary national assessments. This introduces considerable uncertainty about the magnitude and nature of the remaining investment challenge Europe is facing to meet and manage the transition to a low-carbon climate-resilient economy.

To improve the situation the EU and its Member States should rapidly strengthen their capacity to regularly perform domestic climate finance tracking and develop climate finance landscapes to link government spending, bank lending, corporate investment, and asset level data on capital investments. To that end, the study suggests a set of initial building blocks for improved climate finance tracking

The developing policy context in Europe

The EEA welcomes the forthcoming EU sustainable finance strategy as a resource to help outline concrete guidance and actions for how the EU and its Member States can move towards better tracking of climate finance and alignment of financial and climate policy.

The EEA supports the work of the European Commission’s High Level Expert Group on Sustainable Finance.

The EEA encourages efforts to develop forward looking national capital-raising plans related to their climate and energy objectives in order to strengthen investor confidence, increase investment attractiveness and provide certainty in terms of the direction and nature of the supply-pipeline of forthcoming investable projects. These capital raising plans could be stand-alone or be integrated into Climate Adaptation Plans, and into forthcoming National Energy and Climate Plans, or Low-Carbon Development Strategies. National capital-raising plans should also be developed addressing other environmental areas to ensure co-benefits and avoid overlaps.

Figure 1: Outlining the degree of accessibility of climate finance data across EEA Member Countries

Source: own development, map created with MapChart.net

Note: dark green = comprehensive actual spending figures available, light green = limited/partial actual spending figures available, yellow = respondent indicated availability, but figures could not be verified (confidential), red = no figures were found.

Background report from Trinomics.

The European Environment Agency (EEA) is an agency of the European Union. Our task is to provide sound, independent information on the environment. We are a major information source for those involved in developing, adopting, implementing and evaluating environmental policy, and also the general public.

Document Actions

Share with others