This briefing provides an overview of exports of plastic waste from the 28 EU Member States (EU-28) to other countries and discusses its possible consequences and opportunities. It builds on a report by the EEA’s European Topic Centre on Waste and Materials in a Green Economy (ETC/WMGE).

Patterns in the plastic waste trade are changing

A significant proportion of plastic waste is traded, both inside the EU and between the EU and other parts of the world. EU exports of plastic waste to countries outside the EU amounted to around 150 000 tonnes per month at the start of 2019.

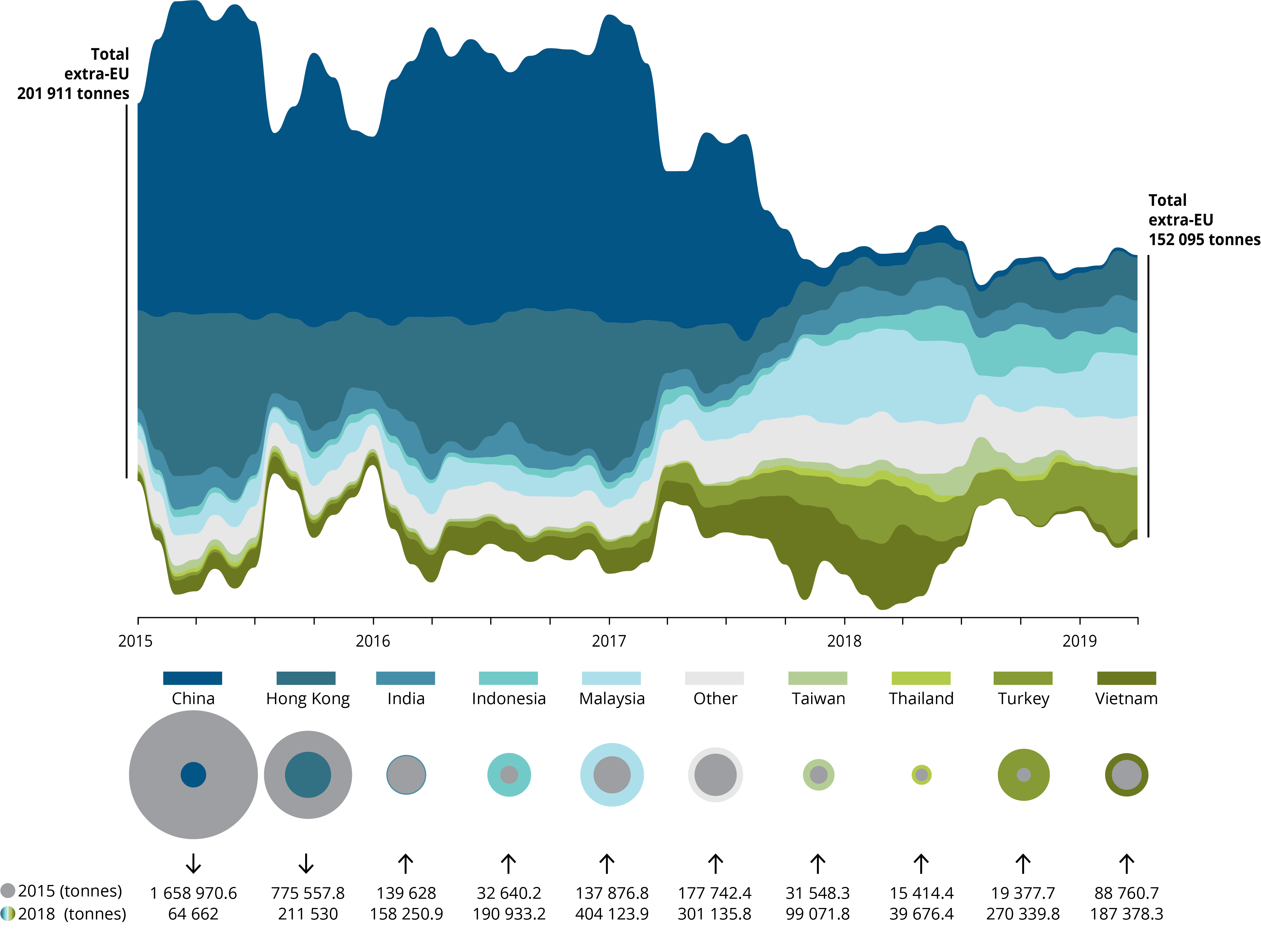

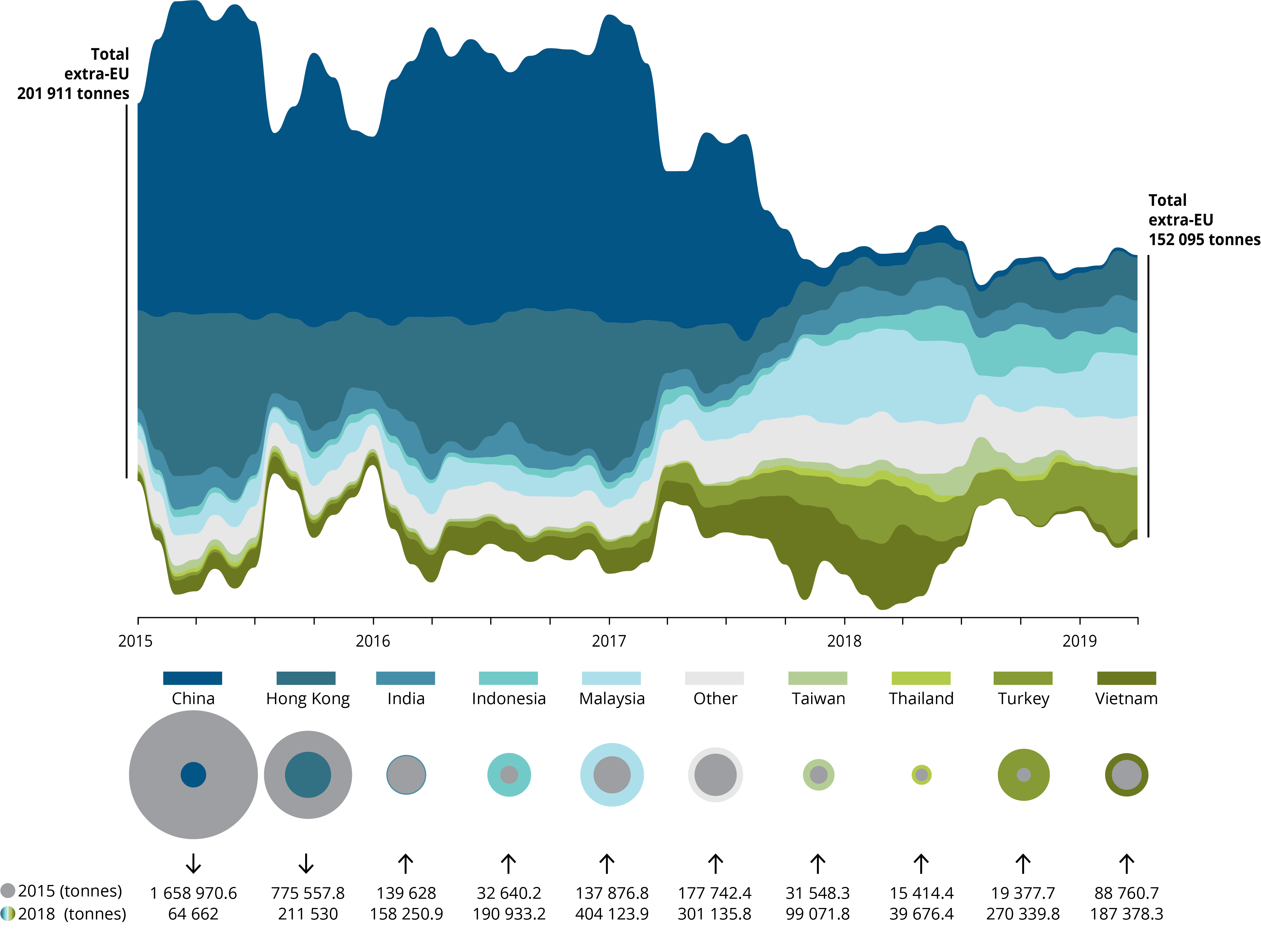

A major redistribution of and reduction in the export of plastic waste from the EU-28 to countries outside the EU took place between January 2017 and April 2019 (Figure 1). As a result of the import restrictions in China, the amount of plastic waste exported to China and Hong Kong has become very limited, and exports have shifted to other destinations.

Sources: Based on Eurostat data (accessed 9 July 2019); ETC/WMGE 2019; EEA.

The trend in decreasing exports of plastic waste is likely to result in an increase in incineration and landfilling in the short term, because of the current lack of capacity to increase recycling and reuse in the EU.

The problem with exporting plastic waste

Awareness of the challenge of managing plastic waste has grown only relatively recently, compared with that of managing materials such as paper, glass and metals. This is one of the reasons why the EU still lacks the capacity to reuse, recycle and recover all of its plastic waste and therefore seeks export opportunities.

Waste is exported because of this lack of capacity and because there is a demand for imports and profits can be made. Exporting plastic waste from the EU to non-EU countries for disposal is prohibited by EU law.

For countries in Asia, imports are an option, as large amounts of plastic waste have an economic value. In addition, these countries do not have the same rules and regulations for waste treatment as those in the EU and can therefore manage plastic waste in a less controlled way.

The factors that determine and drive the export of plastic waste from the EU to other countries (i.e. how much and to where) include:

- tariff and non-tariff barriers and differences in gate fees at treatment facilities

- transport costs

- environmental taxes and policy stringency

- treatment capacity

- legislation and classification

Plastic — and in particular plastic waste — has significant impacts on the environment and climate. Plastic has become a serious challenge for the natural world. Plastic waste is, in most cases, not being handled in a sustainable manner. Instead, it is being dumped on land and ending up in oceans and seas worldwide. And the huge negative consequences for our natural environment are becoming more and more apparent.

Plastic and microplastics destroy marine environments and are either eaten by fish and birds or cause them to become entangled. In many cases, microplastics ingested by fish end up in our bodies through the fish we eat.

At the same time, the production of plastic is largely reliant on fossil fuels. The amounts can be compared with those of the aviation sector. Incineration of and energy recovery from plastic waste result in a direct release of greenhouse gas emissions. When plastic is deposited in landfills, carbon can be released into the atmosphere.

There is a lack of knowledge on the environmental and climate impacts — as well as the social impacts — of exporting plastic waste to countries outside the EU. If plastic waste is mismanaged — e.g. left uncollected, openly dumped, littered or managed through uncontrolled landfills — it will result in pollution and climate change. Mismanaged plastic waste has polluted land-based ecosystems, and 80 % of ocean plastic is estimated to come from land-based resources. Greenhouse gas emissions from plastic production and processing, and from plastic waste management — i.e. from incineration and landfills — are growing rapidly.

At a global level, less than 10 % of about 6 300 million tonnes of plastic waste generated between 1950 and 2015 has been recycled. Over 60 % of the plastic ever made (since 1950) is in landfills or in nature, including in the oceans. The rest has been incinerated or has not been accounted for.

If plastic leaks into the environment, it stays there for a long time and can take up to hundreds of years to break down. This causes damage, harms biodiversity and depletes the ecosystem services needed to support life. Plastic can enter nature in the form of either macroscopic litter or micro- or nanoplastics.

The global rise in the export of plastic waste to China has gone hand-in-hand with the country’s increasing plastic production capacity and local consumption of plastic products. Meanwhile, plastic product manufacturing and reprocessing in China is shifting from many small, unregistered facilities with no standard operating procedures, no quality standards and no inspections to investments in large manufacturing plants, which are subject to increasing quality and environmental controls.

Many of the countries to which the EU exports its plastic waste are still in their infancies with respect to developing waste management. Imported waste is often not processed in accordance with European standards and might even be dumped or burned in unregulated ways. This is despite the fact that EU waste legislation states that recovery operations on exported waste must take place under ‘broadly equivalent conditions’ to those within the EU. Many stakeholders in south-east Asia profit from a lack of legal operators and the failure of authorities to cope with the increased imports.

A lack of knowledge about what happens to exported plastic waste means that, for the environment and climate, it is preferable to handle the waste internally in the EU, gradually increasing the shares reused and recycled as capacity is generated. Europe has a responsibility to safely manage the waste it generates

Changing the trade in plastic waste is an opportunity to make plastic production and consumption more circular

The EU has taken steps to better manage its plastics and plastic waste. These include the European strategy for plastics in the circular economy and new and more ambitious targets for plastic recycling included in the waste directives of 2018.

The Single Use Plastics Directive, which bans and restricts the use of various types of single-use plastics — e.g. knives, forks and straws — from 2021 onwards, marks the beginning of a transition towards making plastics more circular.

EU countries’ trade in plastic waste is regulated by the Waste Shipment Regulation. This prohibits the export of plastic waste for disposal to non-EU countries (except countries in the European Free Trade Area, which are party to the UN Basel Convention) and of hazardous plastic waste for recovery to countries that are not part of the Organisation for Economic Co-operation and Development (OECD).

The recent inclusion of contaminated, mixed or hard-to-recycle plastic waste in the UN Basel Convention (on controlling transboundary movements of hazardous wastes and their disposal) is likely to reduce the plastic waste trade with countries outside the EU as an option for plastic waste management. This is likely to cause increased landfilling in the short term, but it will also be a clear signal for EU countries to move towards a more circular plastic economy. This involves preventing plastic waste as far as possible, as well as managing the waste according to the best environmental standards and the highest potential economic benefits, in particular through reuse and recycling.

From 2007 to 2016, the recycling and recovery of plastic packaging waste — which accounts for the largest fraction of plastic waste and is the category for which reliable data are available — grew significantly (Figure 2). With recycling rates still significantly under 50 % in the EU, there is huge potential to increase the recycling of plastic packaging.

Currently, the management of plastic waste in the EU involves less reuse and recycling than that of more homogeneous materials, such as glass and metals. With the 2018 plastic strategy, the EU has adopted a material-specific life cycle approach to integrating circular design (including through safe by design and safer chemical composition), use, reuse and recycling activities into the plastic value chain.

Currently traded European plastic waste could provide substantial amounts of potential (secondary) material resources for the European manufacturing industry. In addition, recycling in the EU would also provide a net benefit for the European economy, through jobs and added value, and for the environment.

Implementing the EU plastic strategy and the Single Use Plastics Directive will push the EU in this direction by reducing plastic waste with low value and high environmental impact, while improving the quality of plastic waste. This will enable more environmentally and economically sustainable plastic waste management in the EU.

Plastic

Plastic is a family of hundreds of different materials — either fossil fuel based or bio-based — with a wide variety of properties and uses.

Plastic is produced and consumed for many purposes. In 2017, in the EU-28, Norway and Switzerland, the total demand for plastic amounted to about 51 million tonnes, divided among the packaging sector (39.7 %), the building and construction sector (19.8 %), the automotive sector (10.1 %), the electrical and electronics sector (6.2 %), the households, leisure and sports sector (4.1 %), the agriculture sector (3.4 %) and other sectors (16.7 %), according to PlasticsEurope.

Plastic contributes to growth and employment. The European plastic industry is made up of about 60 000 companies, with a turnover of close to EUR 355 billion in 2017, which offer direct employment to over 1.5 million people. About 64 million tonnes of plastic were produced in the EU-28, Norway and Switzerland in 2017.

Document Actions

Share with others