All official European Union website addresses are in the europa.eu domain.

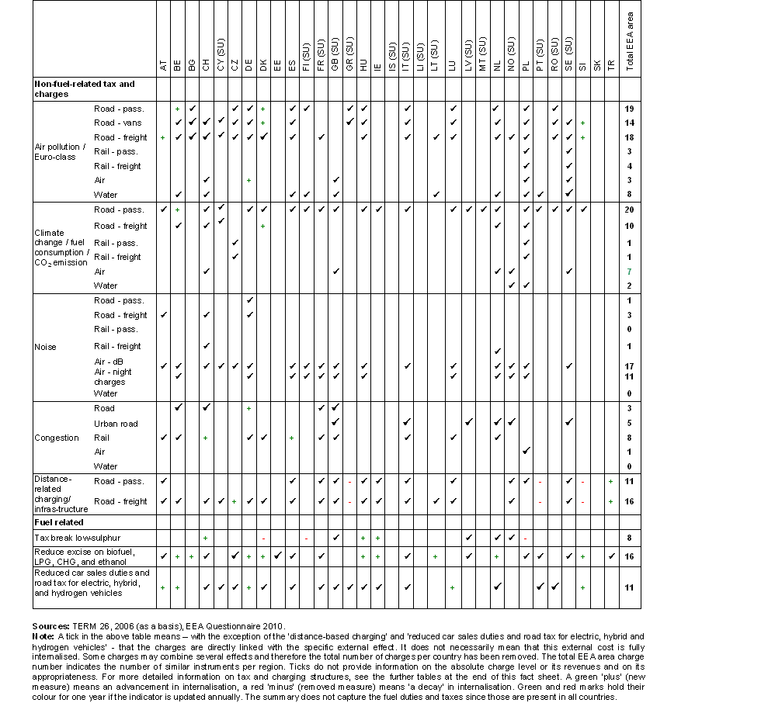

See all EU institutions and bodiesTERM26 Overview of all non-fuel related charges and internalisation policies in EEA-32

Chart (static)

Overview of all non-fuel related charges and internalisation policies in EEA-32

- Iceland

- Switzerland

- Liechtenstein

- Norway

- Greece

- Poland

- Romania

- Portugal

- Spain

- United Kingdom

- Netherlands

- Belgium

- Germany

- France

- Czechia

- Italy

- Cyprus

- Estonia

- Latvia

- Lithuania

- Finland

- Hungary

- Bulgaria

- Malta

- Denmark

- Sweden

- Austria

- Luxembourg

- Ireland

- Slovakia

- Slovenia

Additional information

A tick in the above table means – with the exception of the ‘distance-based charging’ and ‘reduced car sales duties and road tax for electric, hybrid and hydrogen vehicles’ - that the charges are directly linked with the specific external effect. It does not necessarily mean that this external cost is fully internalised. Some charges may combine several effects and therefore the total number of charges per country has been removed. The total EEA area charge number indicates the number of similar instruments per region. Ticks do not provide information on the absolute charge level or its revenues and on its appropriateness. For more detailed information on tax and charging structures, see the further tables at the end of this fact sheet. A green ‘plus’ (new measure) means an advancement in internalisation, a red ‘minus’ (removed measure) means ‘a decay’ in internalisation. Green and red marks hold their colour for one year if the indicator is updated annually. The summary does not capture the fuel duties and taxes since those are present in all countries.