Bank of England, 2021, ‘Key elements of the 2021 biennial exploratory scenario: financial risks from climate change’, accessed 9 November 2021.

Black, S., et al., 2021, Not yet on track to net zero: the urgent need for greater ambition and policy action to achieve Paris temperature goals, IMF Staff Climate Note 2021/005, International Monetary Fund (IMF), Washington, DC, accessed 20 December 2021.

Blank, R., et al., 2021, Mobilität in die Zukunft steuern: Gerecht, individuell und nachhaltig, abschlussbericht zum UBA-vorhaben ‘Fiskalische Rahmenbedingungen für eine postfossile Mobilität’, Federal Environmental Agency (Umweltbundesamt), Dessau, Germany, accessed 20 December 2021.

CCC, 2020, The sixth carbon budget: the UK’s path to net zero, Committee on Climate Change, London, accessed 9 November 2021.

Criqui, P., et al., 2019, ‘Carbon taxation: a tale of three countries’, Sustainability11, 6280.

Defard, C., 2021, A social climate fund for a fair energy transition, Energy & Climate Brief, October 2021, Jacques Delors Institute, Paris, accessed 20 December 2021.

EC, 2018, The 2018 ageing report: economic and budgetary projections for 28 EU member states (2017-2070), European Commission, Brussels, accessed 20 December 2021.

EC, 2019, Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions ‘The European Green Deal’ (COM(2019) 640 final of 11 December 2019).

EC, 2020a, Proposal for a Decision of the European Parliament and of the Council on a General Union Environment Action Programme to 2030 (COM(2020) 652 final of 14 October 2020).

EC, 2020b, Commission staff working document impact assessment accompanying the document Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions ‘Stepping up Europe’s 2030 climate ambition: Investing in a climate-neutral future for the benefit of our people’ (SWD(2020) 176 final of 17 September 2020, Part 1/2).

EC, 2020c, Tax policies in the European Union — 2020 survey, European Commission, Brussels, accessed 20 December 2021.

EC, 2021a, Annex to the Report from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions - 2021 report on the State of the Energy Union - Contribution to the European Green Deal and the Union’s recovery, (COM(2021) 950 final of 26 October 2021).

EC, 2021b, Commission staff working document impact assessment report accompanying the document Proposal for a Council Directive restructuring the Union framework for the taxation of energy products and electricity (recast) (SWD(2021) 641 final of 14 July 2021, Part 1/3).

EC, 2021c, Proposal for a Council Directive restructuring the Union framework for the taxation of energy products and electricity (COM(2021) 563 final of 14 July 2021).

EC, 2021d, Proposal for a Regulation of the European Parliament and of the Council establishing a social climate fund (COM(2021) 568 final of 14 July 2021).

EC, 2021e, ‘Social climate fund’, European Commission, accessed 21 December 2021.

EC, 2021f, Green taxation and other economic instruments Internalising environmental costs to make the polluter pay, European Commission, Brussels, accessed 20 December 2021.

EC, 2021g, The 2021 ageing report: economic and budgetary projections for the EU Member States (2019-2070), European Commission, Brussels, accessed 20 December 2021.

EEA, 2005,Market-based instruments for environmental policy in Europe, EEA Technical report No 8/2005, European Environment Agency.

EEA, 2016,Environmental taxation and EU environmental policies, EEA Report No 17/2016, European Environment Agency.

EEA, 2020,The sustainability transition in Europe in an age of demographic and technological change: an exploration of implications for fiscal and financial strategies, EEA Report No 23/2019, European Environment Agency.

EEA and Eurofound, 2021, Exploring the social challenges of low-carbon energy policies in Europe, Briefing No 11/2021, European Environment Agency, accessed 20 December 2021.

Eurostat, 2021, ‘Environmental tax statistics’, accessed 9 November 2021.

Gago, A., et al., 2019, ‘Taxing vehicle use to overcome the problems of conventional transport taxes’, in: Villar Ezcurra, M., et al. (eds),Environmental fiscal challenges for cities and transport, Edward Elgar Publishing, Cheltenham, UK, pp. 154-167.

Government Offices of Sweden, 2021, Carbon taxation in Sweden, Ministry of Finance, accessed 8 November 2021.

IMF, 2021, Fiscal monitor April 2021, International Monetary Fund, Washington, DC, accessed 20 December 2021.

IMF and OECD, 2021, Tax policy and climate change: IMF/OECD report for the G20 Finance Ministers and Central Bank Governors, April 2021, International Monetary Fund and Organisation for Economic Co-operation and Development, Italy, accessed 20 December 2021.

Kapeller, J., et al., 2021, A European wealth tax for a fair and green recovery, Renner Institut and Foundation for European Progressive Studies, Brussels, accessed 20 December 2021.

NGFS, 2021, NGFS climate scenarios for central banks and supervisors, Network for Greening the Financial System, accessed 23 December 2021.

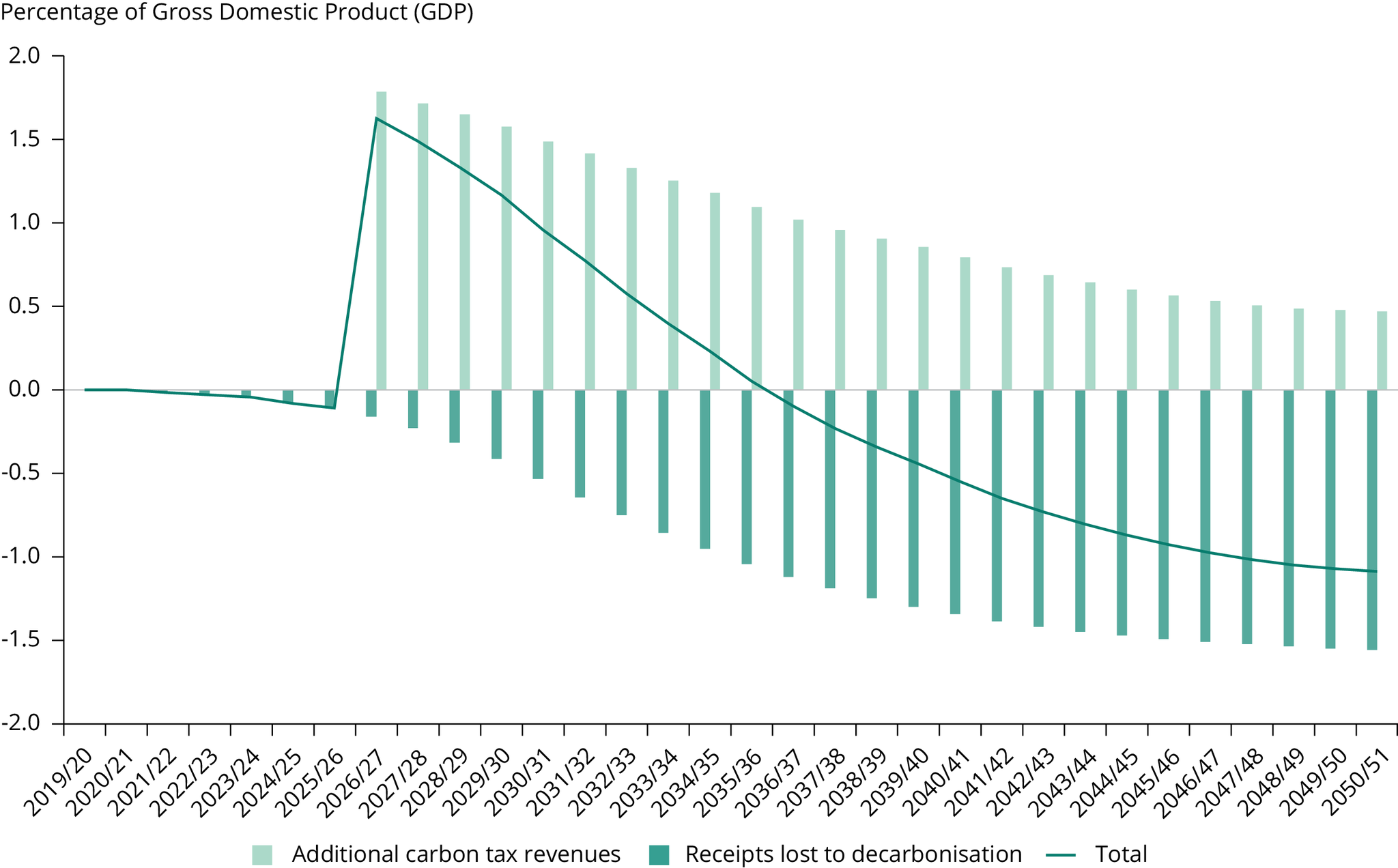

OBR, 2021, Fiscal risks report 2021, Office for Budget Responsibility, London, accessed 20 December 2021.

OECD, 2005, Environmentally harmful subsidies: challenges for reform, Organisation for Economic Co-operation and Development, Paris, accessed 20 December 2021.

OECD, 2013, Government at a glance 2013, Organisation for Economic Co-operation and Development, Paris, accessed 20 December 2021.

OECD, 2020a, Beyond growth: towards a new economic approach, Organisation for Economic Co-operation and Development, Paris, accessed 20 December 2021.

OECD, 2020b, Ageing and fiscal challenges across levels of government, Organisation for Economic Co-operation and Development, Paris, accessed 20 December 2021.

OECD, 2021, Tax and fiscal policies after the COVID-19 crisis: OECD report for G20 Finance Ministers and Central Bank Governors, October 2021, Organisation for Economic Co-operation and Development, Italy, accessed 20 December 2021.

OECD and ITF, 2019, Tax revenue implications for decarbonising road transport scenarios for Slovenia, Organisation for Economic Co-operation and Development and International Transport Forum, Paris, accessed 20 December 2021.

Parry, I., et al., 2021a, Still not getting energy prices right: a global and country update of fossil fuel subsidies, IMF Working Paper WP21/236, International Monetary Fund, Washington, DC, accessed 20 December 2021.

Parry, I., et al., 2021b, Proposal for an international carbon price floor among large emitters, IMF Staff Climate Notes 2021/001, International Monetary Fund, Washington, DC, accessed 23 December 2021.

Pisani-Ferry, J., 2021, Climate policy is macroeconomic policy, and the implications will be significant, Policy Brief 21-20, Peterson Institute for International Economics, Washington, DC, accessed 20 December 2021.

Rouzet, D., et al., 2019, Fiscal challenges and inclusive growth in ageing societies, OECD Economic Policy Papers No 27, Organisation for Economic Co-operation and Development, Paris, accessed 20 December 2021.

Sanderson, B.M. and O’Neill, B.C., 2020, ‘Assessing the cost of historical inaction on climate change’, Nature Research Scientific Reports10, 9173.

Speck, S. and Jilkova, J., 2009, ‘Design of environmental tax reforms in Europe’, in: Andersen, M.S. and Ekins, P., (eds),Carbon-energy taxation: lessons from Europe, Oxford University Press, Oxford, UK, pp. 24-52.

Statistics Denmark, 2021, ‘Environmental taxes by environmental category’, accessed 24 November 2021.

Statistics Norway, 2021a, ‘Environmental economic instruments: Environmentally related taxes (EU/OECD/UN), by type of tax (NOK million) 1995 – 2020’, accessed 15 November 2021.

Statistics Norway, 2021b, ‘Emissions to air: 08940: Greenhouse gases, by contents, source (activity), energy product, pollutant and year’, accessed 22 November 2021.

Statistics Sweden, 2021, ‘Total environmental taxes in Sweden 1993-2020’, accessed 23 November 2021.

Swiss Re Institute, 2021, The economics of climate change: no action not an option, Zürich, Switzerland, accessed 20 December 2021.

Walker, C.C., et al., 2021, ‘Welfare systems without economic growth: a review of the challenges and next steps for the field’, Ecological Economics186, 107066.

Wappelhorst, S., 2021, Update on government targets for phasing out new sales of internal combustion engine passenger cars, International Council on Clean Transportation, Washington, DC, accessed 20 December 2021.

WEF, 2021, Increasing climate ambition: analysis of an international carbon price floor, World Economic Forum in collaboration with PwC, accessed 23 December 2021.

Document Actions

Share with others