Group 5: Price signals

|

TERM indicators

|

Objectives

|

DPSIR

|

Assessment

|

|

14. Transport price (*)

|

promote public transport and rail through the price instrument

|

R

|

?

|

|

15. Fuel prices and taxes (**)

|

differentiate taxes across modes

|

D

|

|

|

19. Proportion of infrastructure

and environmental costs

(including congestion costs)

covered by price (***)

|

full recovery of environmental and accident costs

|

R

|

|

positive trend (moving towards target)

positive trend (moving towards target)

some positive development (but insufficient to meet

target)

some positive development (but insufficient to meet

target)

unfavourable trend (large distance from

target)

unfavourable trend (large distance from

target)

? quantitative data not available or

insufficient

(*) Includes TERM Indicator

18 – Expenditure for personal mobility per person by income

group.

(**) Includes ideas for future development of

the TERM Indicator 16 – Transport taxes and charges

(other than fuel taxes), which cannot currently be shown for lack of

data

(***) Includes ideas for future development

of the TERM Indicator 17 – Subsidies, which cannot

currently be shown for lack of data

Group policy context

Pricing policies can encourage behavioural

changes towards environmentally less damaging and safer forms of

transport. Prices can also influence demand and efficiency by ensuring

that users pay the full cost of transport.

- The European Commission is committed to

developing a fair and efficient Community pricing system. The

objectives are described in the Commission White Paper ‘The Future

Development of the Common Transport Policy’ (CEC, 1992) and the Green

Paper ‘Towards Fair and Efficient Pricing in Transport’ (CEC, 1995).

These argue that taxation should be used to ensure that all external

costs, such as air pollution, accidents, noise and congestion, are

covered in the prices paid by the user.

- The fair and efficient pricing policy relies

on taxes on road transport fuels (CEC, 1998a) and charges for road use

(CEC, 1998c). It also proposes that taxes and charges should be used to

differentiate prices across ‘time, space and modes’ (CEC,

1998d).

- An example of this is the ‘Eurovignette

Directive’ (CEC, 1998b), dealing with charges and taxes for heavy-goods

vehicles, and classifying heavy-goods vehicles in accordance with their

environmental impacts.

- The implementation of the fair and efficient

pricing policy, however, faces many difficulties. In the Commission’s

White Paper on ‘Fair Payment for Infrastructure Use’ (CEC, 1997b), a

phased approach to a common transport infrastructure charging framework

was proposed, but this met many obstacles.

- In its 1998-2004 work programme, the

Commission announced that it will take the necessary steps to launch

the first phase of the programme to apply progressively the principle

of charging for marginal social costs.

Group key findings

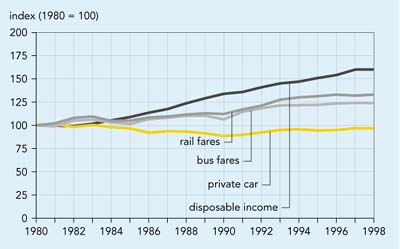

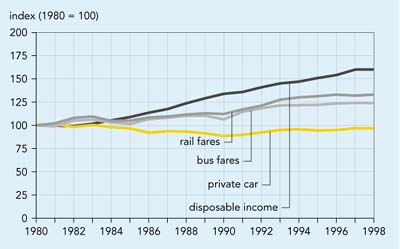

Figure 5.1: Real changes in the price

of transport, United Kingdom

Source: Department of the Environment, Transport and

the Regions, UK (1999)

- Data from the United Kingdom and Denmark

shows that the total costs of car transport (including purchase,

maintenance, insurance, taxes and fuel use) have remained fairly

constant in real terms since the 1980s. Moreover, the perceived

marginal cost (i.e. real fuel price), which often governs decisions on

car use, has fallen in some countries. By contrast, the costs of public

transport have increased at a faster rate than those of car transport.

Changes in prices have therefore encouraged private car use rather than

public transport.

- Currently there is little consistency in

fuel price and tax policies across the EU.

- The external costs of transport in the EU

caused by environmental damage (noise, local air pollution, climate

change) and accidents are estimated at around 4 % of GDP. This

excludes the costs of infrastructure wear and tear, congestion and some

other environmental damage.

- Although methodological and data problems

remain, the current internalisation of infrastructure and environmental

costs is estimated to cover only about 30 % of external costs for

road and 39 % for rail. This shows that even when taxes are

included transport revenues still do not cover all external

costs.

- Harmonised data on taxes (apart from fuel

taxes) and other charges is not available.

- As well as considering the effects of

taxation on demand, it is important to consider the effects of

subsidies. At present, data on subsidies is not collected in a way that

enables an EU-wide indicator to be developed. Such an indicator is

needed as there are believed to be wide variations in subsidy policy

and level across the EU.

Document Actions

Share with others