Indicator 15 (and 16): Fuel prices and taxes

|

- Taxes are a major component of fuel price throughout

the EU. They are differentiated to encourage the use of unleaded petrol

- There is no common trend in overall fuel tax

level between Member States. Fuel taxes are therefore used to provide

incentives to shift demand from leaded petrol to more environment-friendly

fuels, but not generally to reduce overall fuel demand.

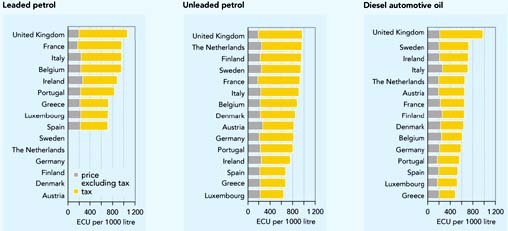

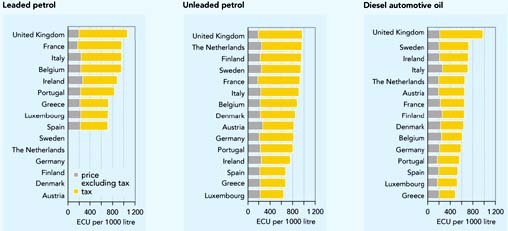

Figure 5.4: Price

structures for leaded and unleaded petrol and diesel automotive fuel (1998)

Source: Eurostat

Objective

Promote

environment-friendly fuels and reduce fuel consumption.

Definition

Fuel

price and the share of tax included in fuel price.

|

Policy and targets

Motor fuel is currently subject to a number of

different taxes, including VAT, excise duty, storage levies, security levies,

and environmental taxes. Fuel taxes provide means for reducing demand. Differentiation

in fuel taxes influences the choice of fuel (OECD, 1998).

The Mineral Oil Directive prescribes minimum

fuel taxes, differentiated between leaded petrol, unleaded petrol and diesel.

All EU Member States comply with this Directive and many countries impose even

higher taxes. Taxation of fuels is also an important component of the overall

EU transport policy to internalise all the costs of transport including environmental

costs.

Several initiatives are underway in Member States

to promote the use of taxes to manage other aspects of transport for example

to reduce congestion, accidents and pollution. Differentiated vehicle taxes

to improve the age profile and efficiency standard of the vehicle fleet are

used in the Netherlands and are under consideration in Ireland. In Germany,

the first phase of an eco-tax reform took place in 1999 with an increase in

fuel tax of 6 pfennig per litre this will be similarly incremented each year

until 2003. From 2001, fuel with a sulphur content of 50 ppm and over will be

subject to an additional tax of 3 pfennig per litre.

Findings

Figure 5.4 shows that fuel taxes vary greatly

between Member States. They account for 65-80 % of unleaded petrol price

and 60-80 % of diesel prices. The tax differentiation required in the Mineral

Oil Directive is reflected in fuel prices. Leaded petrol is the most expensive

in all countries (4-17 % more than unleaded petrol and up to 57 %

more than diesel in 1998), and diesel is the cheapest in most countries. Tax

differentiation has been a major factor in phasing out leaded petrol.

A recent report from ECMT (ECMT, 1999 draft)

finds that, as tax regimes vary between countries the level of fuel excise duty

raised in each does not provide a reliable indicator of the extent to which

infrastructure costs are being recovered.

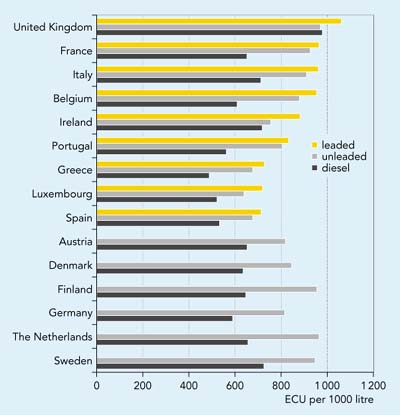

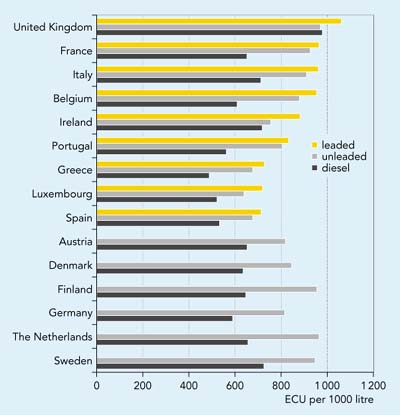

Figure 5.5: Price of petrol and diesel automotive fuel

(1998)

Source: Eurostat

The environmental performance of both petrol and diesel cars

will improve when tighter standards for new cars are introduced following EU

Directive 98/69 (regulating the emissions of carbon oxides, hydrocarbons, NOx

and particulate matter from diesel cars) and as a result of EU Directive 98/70

(regulating diesel fuels, including sulphur content). The Directive comes into

force shortly after year 2000 and will be strengthened (see Indicator 2).

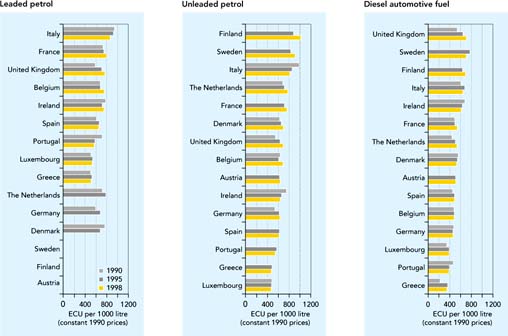

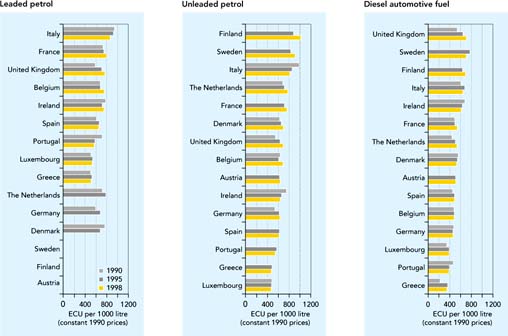

Figure 5.6 shows changes in fuel prices since 1990. There

are large variations between Member States, and no overall trend. In most countries

prices have shown relatively little change in real terms since 1990. However,

in the Netherlands and the United Kingdom real prices of all fuels have risen

steadily, whilst in Greece diesel is more expensive than in 1990 (although it

has fallen from a peak in 1993). Real prices have fallen in several countries,

especially for diesel.

In 1998 unleaded fuel prices were highest in Finland, Sweden

and Italy, and lowest in Luxembourg, Greece and Portugal. Diesel prices follow

a similar pattern, except in the UK where the price is particularly high.

Fuel taxes are in many countries being supplemented with other

transport taxes and charges (e.g. road pricing, Eurovignette, vehicle registration

taxes, tolls). However, comprehensive harmonised data on transport taxes and

charges is not available (see Box 5.2).

Figure 5.6: Fuel price evolution 1990-1998

Source: Eurostat

|

Box 5.2: Transport taxes and charges - the future

TERM Indicator 16

In addition to fuel taxes, Member States apply

various other transport taxes and charges (CEC, 1997b);

taxes associated with buying, hiring, and registering

a vehicle (e.g. VAT and registration taxes);

other taxes payable in connection with the possession

or ownership of a vehicle (circulation taxes and insurance taxes);

taxes directly or indirectly related to the use

of vehicles (e.g. road and bridge tolls, Eurovignette).

When comparing revenues generated by transport

between countries and modes, all these forms of taxes and charges must

be included. However, lack of current harmonised data on these costs has

made it impossible to do so in this assessment.

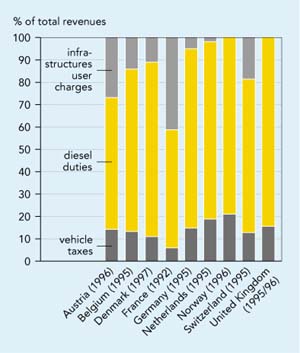

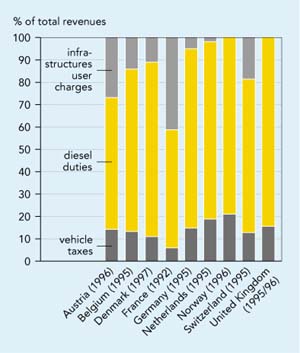

Figure 5.7 shows how fuel taxes have a different

weight in the total burden of freight taxes and charges in each country.

An increase or decrease in fuel duty will therefore have a different effect

in each country. The figure is taken from a report prepared for the Federal

Swiss Transport Studies Service in 1997 which provides a methodological

basis for making comparisons between countries with widely differing systems

of taxation. The ECMT is currently updating this methodology and extending

it to rail transport and passenger transport.

The figure illustrates that some categories of

freight charge are applied in all countries, for example diesel excise

duty. Others (e.g. user charges such as tolls and Eurovignette) apply

only in certain countries. It cannot therefore be concluded that because

one country does not apply a particular charge it is under-recovering

infrastructure costs, or that it might be advisable to introduce the missing

charge. Finally, when comparing systems of taxation between countries,

or evaluating the impact of taxes on road transport other non-transport

categories of taxation (i.e. labour and capital taxation) must also be

taken into consideration.

Figure 5.7: Structure of revenues from road freight

transport

Source: ECMT (1999 draft), Ecosys

(1998)

|

Future work

- Eurostat collects price data for road transport fuel.

No information is available on the price of kerosene for aviation, either

from Eurostat, or from CONCAWE (the European oil industry organisation for

environment, health and safety). The significant environmental impacts of

aviation suggest that kerosene prices should be monitored.

- The European Commission recently proposed a means

of monitoring prices of petroleum products (CEC, 1998a).

- It is intended to extend this indicator to cover

transport taxes and charges other than fuel taxes (see Box 5.2). With the

exception of fuel prices and taxes, data on transport taxes and charges is

still unavailable or incomplete. It is expected that ongoing work by Eurostat/OECD

(regarding statistics on environmental taxes) and ECMT (on international comparison

of road and rail taxation) should soon yield the necessary data to compile

TERM Indicator 16 (transport taxes and charges).

|

Data

Sales price of road transport fuels

Unit: ECU per 1000 litre (1990 prices)

|

| |

Leaded petrol

|

Unleaded petrol

|

Diesel fuel

|

| |

1990

|

1995

|

1998

|

1990

|

1995

|

1998

|

1990

|

1995

|

1998

|

|

Austria

|

?

|

-

|

-

|

?

|

632.9

|

642,6

|

?

|

508.6

|

511,8

|

|

Belgium

|

685.5

|

685.2

|

754.8

|

643.6

|

615.2

|

695.6

|

479.8

|

486.2

|

481.9

|

|

Denmark

|

768.6

|

682.7

|

-

|

634.7

|

662.8

|

704.2

|

557.9

|

541.7

|

528.7

|

|

Finland

|

?

|

-

|

-

|

?

|

890.4

|

1022.0

|

?

|

637.9

|

692.1

|

|

France

|

734.6

|

750.7

|

798.0

|

?

|

722.4

|

766.3

|

492.3

|

494.2

|

539.5

|

|

Germany

|

597.0

|

685.0

|

-

|

545.2

|

628.2

|

637.5

|

473.9

|

457.1

|

461.2

|

|

Greece

|

508.4

|

530.0

|

512.3

|

?

|

493.6

|

476.8

|

222.1

|

363.6

|

343.6

|

|

Ireland

|

782.6

|

720.0

|

750.2

|

758.8

|

669.8

|

641.5

|

682.1

|

633.1

|

610.3

|

|

Italy

|

943.8

|

925.7

|

866.4

|

996.6

|

864.1

|

820.2

|

605.6

|

679.2

|

641.6

|

|

Luxembourg

|

512.9

|

546.0

|

535.2

|

491.4

|

482.2

|

474.9

|

345.1

|

391.1

|

388.2

|

|

Netherlands

|

722.3

|

786.5

|

-

|

692.0

|

721.0

|

783.5

|

440.8

|

503.5

|

533.3

|

|

Portugal

|

720.2

|

586.4

|

569.9

|

?

|

579.0

|

551.3

|

465.4

|

392.2

|

385.0

|

|

Spain

|

615.0

|

665.7

|

656.0

|

?

|

630.4

|

622.3

|

452.4

|

487.3

|

490.1

|

|

Sweden

|

?

|

-

|

-

|

?

|

838.4

|

916.8

|

?

|

772.9

|

702.4

|

|

United Kingdom

|

590.8

|

710.2

|

765.9

|

555.6

|

642.1

|

699.9

|

538.4

|

644.4

|

706.1

|

Note: Leaded

petrol is no longer sold in Austria, Denmark, Finland, Germany, Netherlands

and Sweden.

Source: Eurostat |

|

Price structure of road transport fuels (1998)

Unit: ECU per 1000 litre

|

| |

Leaded petrol

|

Unleaded petrol

|

Diesel petrol

|

| |

price excluding taxes

|

tax

|

sales price

|

price excluding taxes

|

tax

|

sales price

|

price excluding taxes

|

tax

|

sales price

|

|

Austria

|

-

|

-

|

-

|

271.6

|

546.8

|

818.5

|

192.9

|

458.9

|

651.8

|

|

Belgium

|

228.3

|

725.7

|

954.0

|

224.1

|

655.0

|

879.1

|

244.5

|

364.5

|

608.9

|

|

Denmark

|

-

|

-

|

-

|

228.4

|

617.1

|

845.5

|

227.4

|

407.4

|

634.8

|

|

Finland

|

-

|

-

|

-

|

226.8

|

727.8

|

954.6

|

256.3

|

390.1

|

646.5

|

|

France

|

173.7

|

790.0

|

963.7

|

183.3

|

742.1

|

925.4

|

222.2

|

429.3

|

651.5

|

|

Germany

|

-

|

-

|

-

|

208.7

|

605.8

|

814.5

|

209.7

|

379.6

|

589.3

|

|

Greece

|

213.1

|

513.5

|

726.6

|

223.9

|

452.4

|

676.3

|

203.3

|

284.1

|

487.4

|

|

Ireland

|

264.2

|

617.8

|

882.0

|

243.6

|

510.5

|

754.2

|

212.1

|

505.4

|

717.5

|

|

Italy

|

234.3

|

727.1

|

961.4

|

237.1

|

673.0

|

910.1

|

262.1

|

449.9

|

712.0

|

|

Luxembourg

|

230.1

|

489.4

|

719.5

|

226.0

|

412.4

|

638.4

|

172.9

|

348.9

|

521.8

|

|

Netherlands

|

-

|

-

|

-

|

250.5

|

713.3

|

963.8

|

195.8

|

460.2

|

656.0

|

|

Portugal

|

222.7

|

608.9

|

831.6

|

229.1

|

575.2

|

804.4

|

170.9

|

391.0

|

561.8

|

|

Spain

|

219.6

|

493.3

|

712.9

|

220.3

|

456.0

|

676.3

|

196.2

|

336.4

|

532.6

|

|

Sweden

|

-

|

-

|

-

|

245.9

|

700.6

|

946.6

|

203.4

|

521.8

|

725.2

|

|

United Kingdom

|

195.2

|

866.1

|

1061.2

|

193.1

|

776.7

|

969.8

|

216.0

|

762.4

|

978.4

|

Note: Leaded petrol

is no longer sold in Austria, Denmark, Finland, Germany, Netherlands and

Sweden.

Source: Eurostat |

Document Actions

Share with others