Use of economic instruments in environmental policy in Estonia

One of the main challenges for the future is to promote environmentally

sound means of production, increasing more efficient resource use and greening

of the economies. Suitable measures for such purpose include market-based

instruments, such as environmental taxes and charges which, supported by the EU

and OECD (for example by the European Commission Green Paper in 2007),

have become popular in many countries.

Use of economic instruments in environmental policy is also important in

Estonia

as these tools have proved to be effective in meeting policy objectives. The

basis for development of economic instruments for environmental protection is Estonia’s

national strategy for sustainable development, ’Säästev Eesti 21‘ and the

Estonian Environmental Strategy 2030 along with the action plan for 2007-2013. The

outcomes of the measures taken should be in accordance with the objectives in

strategic basic documents in environmental sectors (for instance, the National

Waste Plan 2008-2013). Development of environmental charges and taxes takes

into account the bases for environmental tax reform

approved by the Estonian government in June 2005 and the principles of the

development of environmental charges up to 2020, discussed in the government in

2009.

Estonia

has used economic instruments for environmental protection since the 1990s.

Environmental taxes used currently include the fuel excise duty, the excise

duty on packaging and the heavy goods vehicle tax. An excise duty on

electricity was established in 2008. Excise duties in Estonia have,

however, primarily revenue objectives. The most important tool in achieving the

objectives of environmental policy and the polluter/consumer-pays principle is

environmental charges, which have also been implemented since 1991. The grounds

for implementation of environmental charges and procedures for calculation and

payment, rates and use of the state budget revenue from the charges are

governed by the Environmental Charges Act and acts thereunder.

An environmental

charge is a price placed on the right to use the environment. The purpose of

environmental charges is to avoid or reduce potential losses related to natural

resource use and emissions of pollutants into the environment and waste

disposal. Environmental charges are applied to motivate undertakings to invest

in production with a lower environmental load and to use Estonian natural

resources more efficiently and sustainably. In order to be effective and have

necessary motivating power, environmental charge rates have to be set on a

sufficiently high level. Applying the necessary rate levels in practice is

often a big challenge, as there are international competitiveness and social

inequality issues involved. The main types of environmental charges in Estonia

are natural resource charges and pollution charges. Natural resource charges

include water abstraction charges, applied when ground or surface water is

abstracted; mineral extraction charges, applied when minerals (such as peat,

gravel etc) are extracted from the natural environment, and other charges on

natural resource use (fishing, hunting etc). Charges on pollution include air

pollution charges on emissions (SO2, NOx, CO2

etc), water pollution charges (on N, P etc), and charge on depositing waste on

landfills.

Environmental charges were originally established at very low rates

considering the modest purchasing power of the population and to support

entrepreneurial development. The rates rose in 1991-1994 pursuant to the

consumer price index. As the economy developed, it was possible to devote more

attention to environmental protection, and thus from 1996, a 20 % yearly

increase was applied to the rates and in the case of fees for natural

resources, the rate rose 5-10 % a year. In 2005, the government decided to

apply the principles of environmental tax reform, as a result of which the

levels of all environmental charges were increased significantly in 2006. The

rise in rates stemmed from the need to make economic instruments more effective

and give producers and the population a clear signal that the Estonian state

wanted to use its natural resources and environment sustainably. In 2007,

moderate growth of charge rates continued and it can be said that in some cases,

the charge rates are now approaching a level where their stimulus effect on

environmental protection is becoming evident. Adjustment and increase of the charge

rates is, however still necessary in the future for better policy targeting. In

2009, the Government discussed the principles of development of the

environmental charges until year 2020, a paper prepared in cooperation with various

interest groups. The aim of this process was to give an advance signal to the

polluters and natural resource users that the value of natural resources and the

cost of environmental pollution will be even higher in the future. Presently

the environmental charges rates are determined in legislation until 2015.

Over the years, revenue from environmental taxes and charges has

increased, as the impact on the environment has increased in some regards (for

example, use of natural resources and waste generation has increased) and the

rates of environmental charges have gradually increased. On the other hand,

there are many examples where pollution reduction has occurred due to the

motivating effect of environmental charges. For example in the water sector,

municipal wastewater treatment plants have been reconstructed in bigger towns (Tartu, Viljandi etc) while

in smaller regions, relatively undemanding and low-cost but significantly pollution-reducing

solutions for wastewater treatment system renovation have been introduced. In

the waste sector, companies have started to search for innovative ways to

reduce the share of deposited waste - for example a mining company has

successively developed production of mineral construction material from the

mining waste. This also indicates a reduced need for opening new mines and

therefore lower pressure on the natural environment. Additionally, reuse of

waste in producing refuse-derived fuel (RDF) has increased recently in Estonia.

Hence, companies have admitted that increasing environmental charges have been

the real stimulators of environment-related investments.

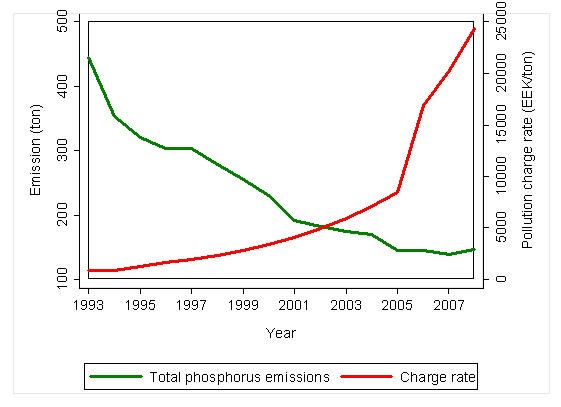

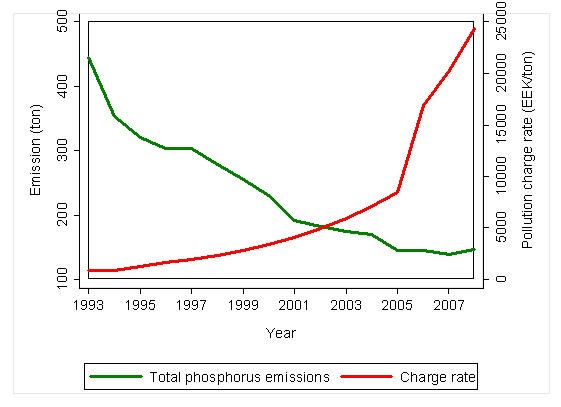

Due to the motivating effect of increasing environmental pollution

charges and resulting investments in the water sector, emissions into water decreased

during 1993–2007. The following graph presents the trend of reduction of total

phosphorus emissions into water, but similar results can be reported for other

pollutants and economic sectors.

Figure: Pollution charge rate and

the trend of reduction of total phosphorus emissions into water.

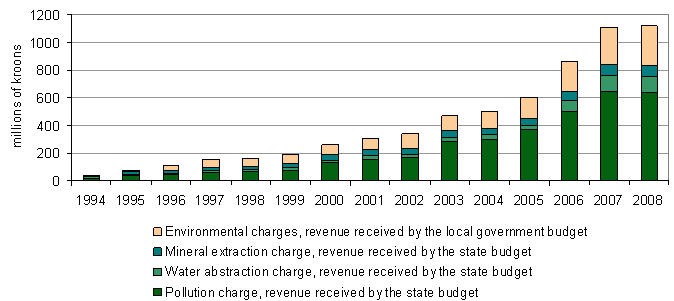

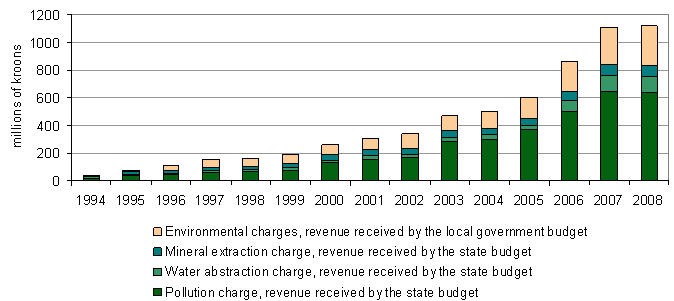

The annual revenue of environmental taxes and charges in 2008 was 6 446

million Estonian kroons (EEK), from which environmental charges amounted to 1 365

million EEK. Environmental taxes and charges in GDP have increased from 0.95 %

in 1995 to 2.56 % in 2008.

Figure: Revenue from environmental charges

1994–2008. Note: The figure reflects only revenue from pollution charges,

charge for water abstraction and mineral extraction. Data: Ministry of the

Environment.

Green Paper on market-based instruments for

environment and related policy purposes. 28.3.2007 COM(2007) 140 final [http://eur-lex.europa.eu/LexUriServ/site/en/com/2007/com2007_0140en01.pdf]

For more detailed information

on Estonian environmental taxation system see Lüpsik, S. “Estonian Ecological

Tax Reform Successfully Launched” in “Critical Issues in Environmental Taxation

International and Comparative Perspectives. Volume V”. (Editors: N. Chalifour,

J.E Milne, H. Ashiabor, K. Deketelaere and L. Kreiser; Oxford University Press,

2008).

There are currently no items in this folder.

Document Actions

Share with others